A convertible note, also known as a convertible debt, is a short-term loan that is converted to equity, the company's shares. Such a tool allows for raising funds without spending months negotiating and engaging in daunting bureaucracy with high lawyer fees. Getting timely investments can be a lifesaver for many organizations, large and small.

This article will discuss what a convertible note is and how it works. It will present an example of such a financial tool in action, the key clauses you cannot miss, and discuss its benefits and drawbacks as a method of raising funds.

What is a Convertible Note?

A convertible note is basically debt that can be converted to equity. As a company, you promise to give shares in the future for the capital received today (under several clauses and conditions).

The main reason why convertible note is popular among the private equity market is that it allows raising funds quickly without needing to set a company valuation. We will explain why that is the case later on.

A transaction that involves convertible debt has two parties: a party that grants the note (e.g., a founder who raises money in exchange for the note) and a party that receives the note (e.g., an investor that provides capital to the company).

Every convertible note has a set of clauses that need to be agreed on by the two parties. The discussion of these should involve the steps that go into the process - from agreement to conversion - and the events that can trigger such a process of converting debt to shares (equity). And that is the topic of the next section.

How Does a Convertible Note Work?

Step 1 - agree on the terms and clauses of a convertible note:

Before any money exchanges hands, two parties - an investor and a founder - need to discuss all the underlying conditions and clauses of such a transaction.

What are the clauses of a convertible note?

There are 5 key elements of convertible debt:

-

Interest rate - since the convertible note is debt, the investor earns interest while holding the note. At the moment of conversion, the earned interest will usually be a part of the capital converted to equity. The higher the interest rate, the more shares the investor will receive for the contribution. It is typically around 5-6%. However, having a convertible note without interest is possible. It is not an obligatory element, but rather something that is up to the negotiations and subject to your country’s laws.

-

Maturity date - a date when the note is due to be repaid (investment + interest) if it has not been converted yet (no trigger event has happened yet). However, when convertible debt is not converted at maturity, investors typically agree to postpone the maturity date (e.g., for another year). The goal is to allow companies to get to the conversion event. Such a decision benefits both parties: investors still have a chance to get a return and convert debt to equity, and a company can still function without having to pay back the capital.

-

Trigger event - the note is typically converted when a new qualified financing round takes place (e.g., a new investor comes in, agrees on the company’s valuation and invests under several conditions).

-

Valuation Cap - the maximum valuation at which the investor's capital will be converted to equity. The implications of such a clause will become more clear in the example later on.

-

Discount rate - the percentage given to an investor at which the capital contribution will be converted to equity. If an investor receives a convertible note with a discount of 20% at the moment of conversion, the capital can be converted under favorable terms - acquiring shares at 80% instead of the total price.

The conversion process can be done using the valuation cap or the discount. It depends on the scenario that provides the lowest price, which means the highest number of shares for the investment.

Step 2 - the convertible note agreement is reached:

When an agreement is reached, a contact needs to be signed for the exchange to take place. Did you know that being able to sign contracts with e-signatures (online) can save you unnecessary lawyer fees and time. Capboard offers such an e-signature tool so you can move the agreements forward faster and hassle-free.

At the start date of the convertible note agreement, the investor begins to earn interest (given that it is >0%). At this point, the founder does not give any shares of the company to the investor for its capital. At least, not yet.

Since no shares are granted, it is not necessary to set a company valuation. That is one of the main reasons why convertible notes are used. For example, valuations at the early stage cannot be reliable and are close to impossible to be done. But companies still seek capital investments. And that is why a convertible note emerged. It allows such a fundraising event to occur: easily and quickly.

Step 3 - the conversion event is triggered:

As mentioned, conversion is often triggered when a qualified financing event takes place. Such an event represents an equity fundraising priced round when a new investor comes in and agrees to provide capital for equity (at a predetermined price). That means there is a need for a company valuation.

At this stage, an agreement needs to be reached between the new investor and the founder. What concerns the note holder in that case is the company’s valuation.

Step 4- the note conversion and a new investing round take place:

When the new investment round details are known and the conversion event is triggered, the prices for different investors are computed, and shares are allocated.

Here, it is essential to see how the new financing dilutes the existing shareholders (e.g., founders). To get a clear picture of the process, we are going to present an example of a situation when convertible debt is not converted at maturity but when triggered by a priced funding round event.

Convertible Note Example

Here is an example of when a convertible note is converted into equity.

Convertible Note Example Clauses

Imagine a startup has raised $500 000 as a convertible loan financing. Before the convertible note agreement is signed, the company is owned by two founders with 1 million shares each (2 million total).

Moreover, the convertible note has several clauses:

-

Interest rate = 5%, which adds to the principal amount (investment)

-

Discount rate = 20%

-

Pre-money valuation cap = $5 million

Since it's not always clear what you need to choose - discount or cap - when calculating the ownership percentages, here is how to find out.

Firstly, it is crucial to calculate the conversion price per share and the number of shares that will be received. To do so, there is a need to have more data on the trigger event - the qualified financing round that takes place in the future.

The new priced round (trigger event) clauses and calculations

The event that triggers the conversion of the convertible loan is typically a new priced round (also known as a qualified financing event).

The new investor comes in, and the following clauses are:

-

The new investor will provide $1.5 million

-

The pre-money valuation is $10 million

The price per share for the new investor is calculated by dividing pre-money valuation by outstanding shares (owned by founders):

New investor share price = $10M ÷ 2M shares = $5 per share.

At this price, the new investor will receive:

$1.5M ÷ $5 = 300 000 shares.

Conversion of the note

Given that we know the company's pre-money valuation and share price under the new funding round, it is now possible to compute the conversion price for the noteholder.

This price is the minimum of the two scenarios: either when the valuation cap is considered or when the discount is applied to compute the price.

Valuation cap scenario:

New investor price per share * (Valuation cap ÷ Pre-money valuation) = $5 * ($5M ÷ $10M) = $2.5 per share.

Discount scenario:

New investor share price * (1 - discount rate) = $5 * (1 - 0.2) = $4 per share.

Given that the typical condition under a convertible note agreement is that the chosen price should be the most desirable for the investor (the minimum of the two), the shareholder conversion price is $2.5 (using the valuation cap).

Under such conditions and assuming that the priced round that triggers the conversion is 1 year after the convertible note agreement was signed, the convertible loan is converted in the following way:

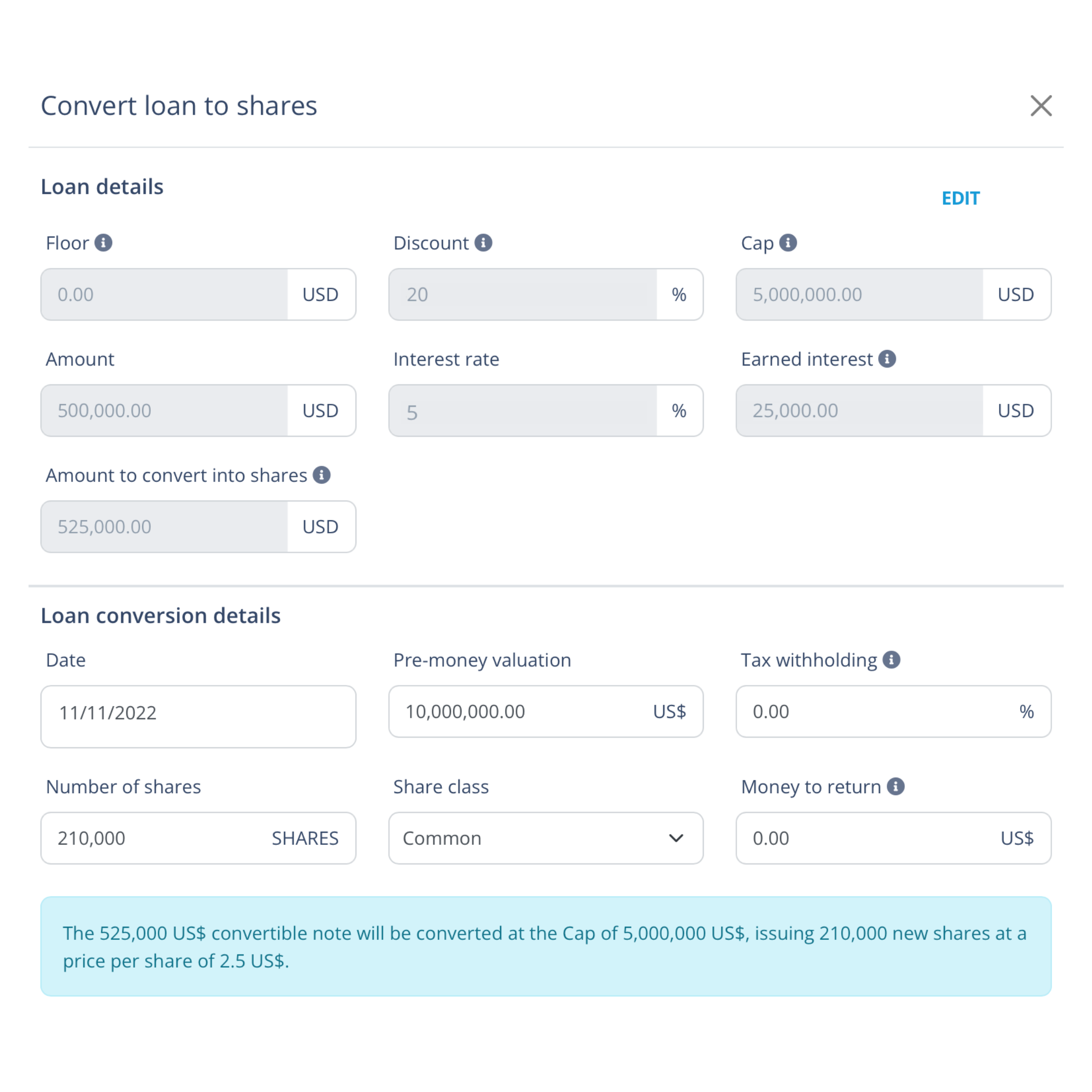

Interest earned after 1 year:

Principal investment * interest rate = $500 000 * 0.05 = $25 000

Then the convertible loan to equity process is the following:

(Investment principal + interest earned) ÷ convertible note price = ($500 000 + $25 000)÷ $2.5 = 210 000 shares are issued and granted to the noteholder.

At Capboard, we make all the calculations for you and convert the notes at the lowest price (calculating the price using either the valuation cap or a discount):

The effect on the cap table and ownership

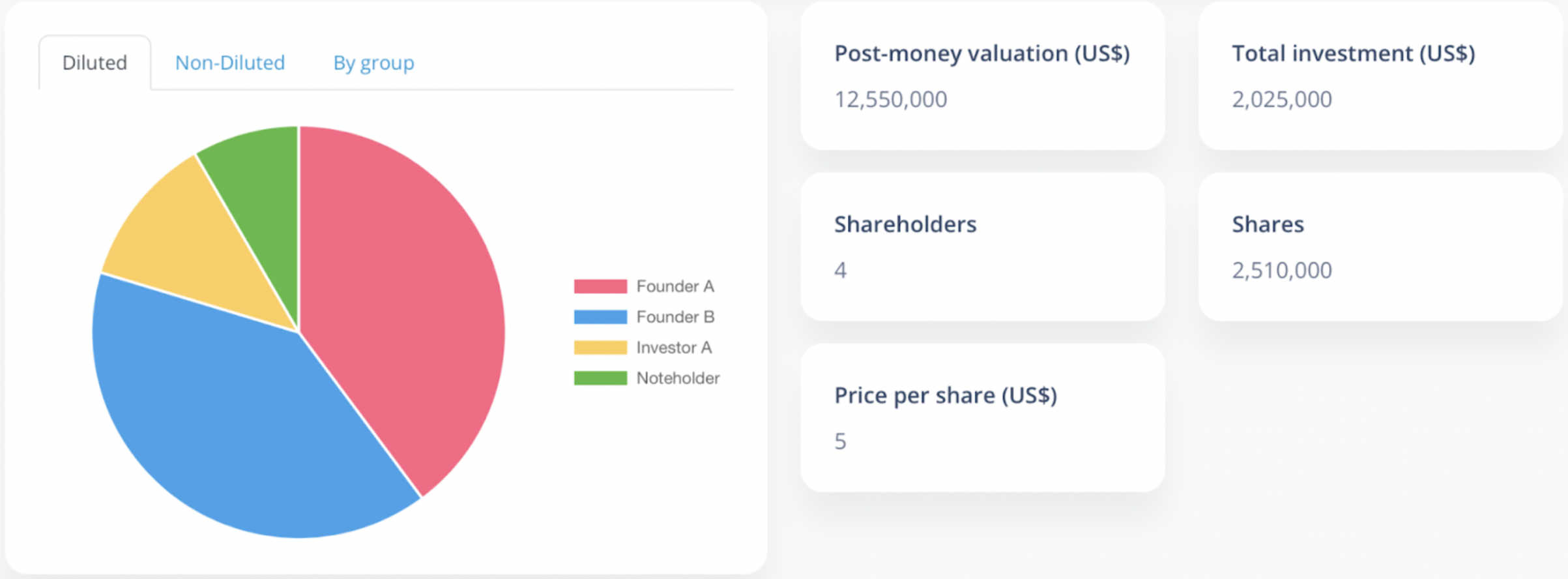

After the investment takes place and the note is converted to equity, the share ownership data is the following:

-

Founders = 2 million shares

-

Early investor (convertible noteholder) = 210 000 shares

-

New investor (priced round) = 300 000 shares

Here you can see how the equity ownership changes after the conversion of the note and the new funding round take place:

After the new investors receive their equity stakes, the founders are diluted by a total of 20.32%. The new investor receives 11.95% of the equity, which represents 300 000 shares. In turn, the early investor that converted its note into shares owns 8.37% of the company’s equity and that is 210 000 shares.

Finally, the cap table would look like that:

Do you want to know what it takes to create convertible notes on Capboard and be able to convert them to equity? Read more on convertible notes at Capboard.

Convertible Note for Startups: Advantages and Disadvantages

The main advantages of a convertible note :

-

A great way of getting funding without setting a valuation;

-

Shorter negotiations process compared to a priced funding round;

-

Allows using incentives (e.g., discounts) to create urgency in investors.

The disadvantages of convertible loans :

-

Limited control - noteholders are not stakeholders of the company (before the convert their debt to equity), limiting their rights.

-

Unpredictability and uncertainty - convertible debt presents a lot of ambiguity for noteholders. Will the qualified financing round happen soon in the future? How much equity will the noteholder own? Are all the key clauses agreed on and specified in the contract?

Easier Fundraising using Convertible Notes with Capboard

Convertible note agreements do not have to be complicated or scary. At Capboard, we help you along the way and provide the tools you may need along your fundraising:

- Simulating financing rounds with convertible notes can 10X your understanding of the process and provide you with crucial knowledge to ensure you are not taken advantage of.

- E-signing agreements and sharing and storing contracts all in one place allows you to save 100% of your time doing repetitive, non-value-added manual work.

Do you want to be the most knowledgeable person at the negotiation table when it comes to convertible notes? Then start now.