An employee stock option plan (ESOP), also known as an employee stock ownership plan, is a financial compensation tool used by founders, CFOs, and HR representatives to motivate, compensate and align employees with the company’s goals. A long-term approach for long-term objectives, one might say. Setting up an ESOP can become a game-changer for your business, helping you create a committed and excellent team.

What is an ESOP?

In simple terms, an ESOP is a key part of the compensation plan offered to employees, which may also include salary and other benefits. Companies create a pool of shares they want to grant employees or key advisors (an ESOP pool). These grants represent a possibility to acquire shares at a discounted rate (usually at an 80% discount from the fair market value). Stock options, stock and phantom shares (virtual stock options) are the most common financial instruments used. However, depending on the type of financial instrument, the implications for the equity ownership (cap table), employees and employers are different (process-wise and legal-wise). These differences will be explained later on.

Let us now define a few key terms that will come in handy later on:

- The exercising - the process of using the given rights. In the case of grants of stock options, an exercise event can involve using cash to buy stocks.

- The strike price- the price at which the employee can buy the share, usually at a discount from the fair market value.

- The start date - the moment when an accumulation of stock options begins.

- The expiry date - the day when the stock options expire and can no longer be exercised.

- Cliff period - the period during which the employee cannot yet exercise the stock options in case of leaving (typically 12 months).

- Vesting period - the period when the stock options vest and accumulate (typically 4 years). Employees usually receive a proportional number of stock options each month during the vesting period. At the end of it, they will accumulate, vest, all the stock options that were granted to them.

- The exercise window - the period of time when stock options can be exercised (bought and sold).

If you have any questions about these, feel free to ask me by sending an email to info@capboard.io with the subject line “ESOP article - question”.

How does an Employee Stock Option Plan work?

There are 3 typical financial instruments used for ESOPs: stock options, stock and phantom shares.

Stock options

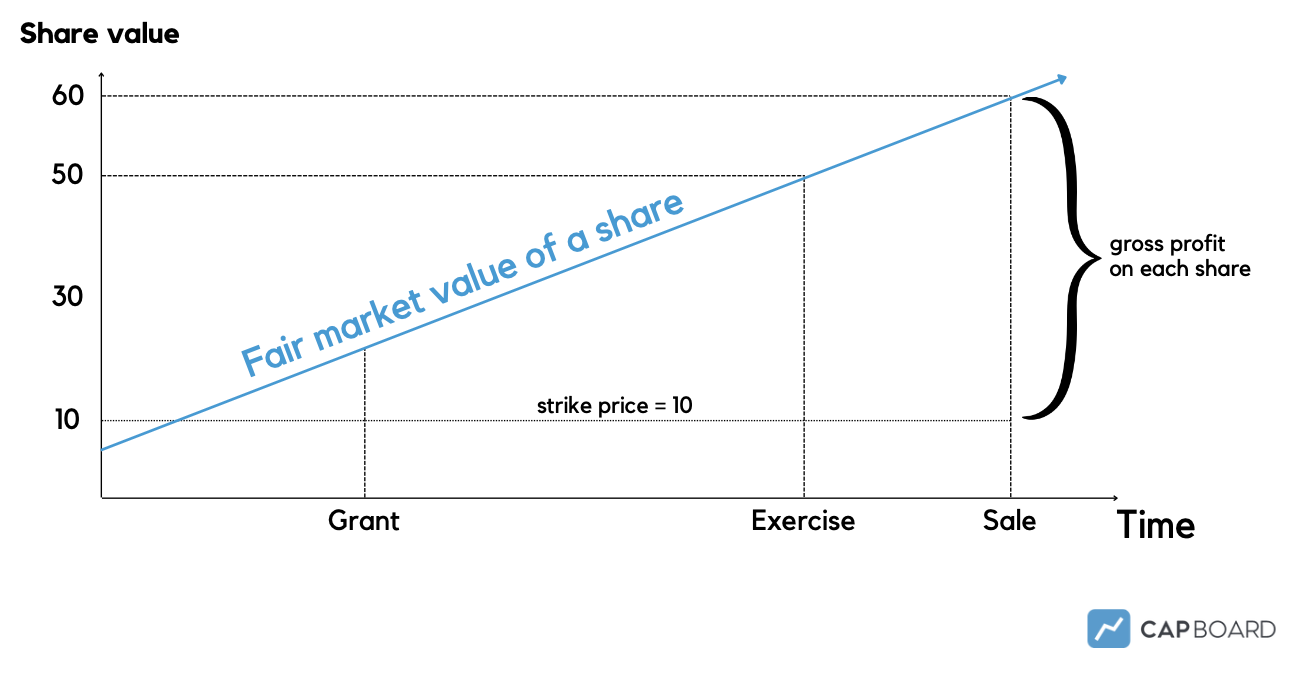

Mainly, companies use stock options for their compensation plans. When these are granted, employees receive equity upon exercising under several conditions. The process can be explained using the graph. Observing it below, we can see that the grant date and the exercise date are different. The gap represents a cliff period under the vesting schedule that needs to pass before an employee can exercise.

For example, an employee can choose to exercise a desired number of vested (available) shares whenever she wants, during the exercise window. At the point of the exercise, the employee buys shares and pays only the strike price of $10,which represents a plan’s condition where an employee receives an 80% discount and pays only 20% of the fair market value of $50 ($50*0.2=$10). Moreover, to gain from the value increase, she holds these shares until deciding to sell.

It is essential to understand that the graph represents an ideal scenario where a company survives and its shares rise in value. However, since the world isn’t all rainbows and unicorns, there is a chance that companies’ shares don’t grow. In that case, an employee will have to think twice before deciding to exercise the grants and buying shares that have not (yet) grown in value.

Graph: An ideal scenario when granted employee stock options

Stock

Companies can use other types of financial instruments as a part of their compensation plan. In the case when stocks are granted, employees receive shares at the moment of the grant. So these can be exercised right away without the need to wait for the vesting process to happen. Thus, employees can exercise the grants whenever they desire and become shareholders of the company at that moment.

Phantom shares

Phantom shares , also known as virtual stock options, work similarly to stock options. However, upon exercising or when the liqudity event (stakeholders can cash out their ownership: acquisition, merger, IPO) happens, employees receive cash directly rather than equity. It means that employees are granted the right to a payment at a prespecified time or during particular circumstances such as a liquidity event.

So, after having described what an ESOP is and how it works, let us now see how it can help your business and why it continues to gain popularity among companies all over the world.

SARs

Stock Appreciation Rights (SARs) is not a common type of equity compensation. SARs allow employees to benefit from the appreciation of a company's stock price. SARs owners are compensated with cash distributions that equal to the increase in stock price over a particular period. However, it is possible to settle with the issuance of stock for the amount equal to the compensation. Either way, employees don't need to pay in upfront costs to benefit from this type of equity compensation.

Warrants

Warrants are agreements between a company and another party that gives them the right to purchase the company's shares at a specified price.Warrants are primarily issued to investors.They can be exercised at any time, and the company has to issue shares when it happens. Warrants have an expiration date. After this date, the investors can no longer exercise their right to buy shares. Similar to stock options, warrants can have a vesting schedule. It can be time-based or performance-based, depending on the needs and wants of this relationship.

ESOP Benefits for Your Startup

The team is the backbone of any business entity. Aligning them with their company’s long-term success may be a complicated task but necessary for an organization to survive and thrive. ESOP does precisely that.

Since ESOP is a form of employee compensation, the main benefits are the following:

- Aligning the incentives with key employees in the long term: improves their commitment and overall talent retention.

- Key compensation lever to be able to afford great talent without using the cash to pay for it. It's just another social benefit to offer to your employees.

- Great for the local ecosystem, as successful startups and companies with an ESOP will create a new generation of founders, owners and investors.

Such a compensation plan allows workers to reap the benefits of their long-term contribution. It promises them to be compensated in the future with employee equity if the business grows.

Also, having performance-oriented workers with a long-term perspective intends to unlock the workforce’s full potential. Employee stock options aim to bring employees and companies closer, aligning them with the goal of increasing the value of businesses (making the pie bigger for everyone). Moreover, an ESOP focuses on improving employee performance while encouraging positive behavior in the way the work is done. For example, workers are expected to become more conscious regarding:

- the way they spend time during working hours,

- what activities truly make an impact and create value for the business,

- how they interact with their co-workers, and the kind of impact they have on them.

Overall, an ESOP is one of the advanced ways to improve employee engagement. Therefore, we can say that an employee stock option plan is designed to bring out the best in your workers.

An extensive study on privately held companies found that businesses with ESOPs reported higher sales, employment, and sales per employee data than their counterparts with no ESOP. Also, it was found that the survivability of ESOP companies is somewhat higher compared to non-ESOP businesses. Even though the study dates back more than 20 years, we can expect that the human desire to be fairly compensated for their impact has not changed.

With this in mind, it is reasonable to say that an ESOP answers one of the executive’s most-asked questions concerning how to improve employee engagement and performance. Now you may be thinking: “It must involve a lot of legal stuff and bureaucracy. How will I be able to set it up with limited time and resources?” Fair point! Let us move to the exciting part of the article so we can address your concern and discuss how you can quickly launch an ESOP by yourself or with some help from our CEO ;)

How to Set Up an ESOP in 3 steps

ESOP may sound complicated, but it is simple to launch when you have the right tools. At Capboard, we believe that top employees are greatest assets. To ensure that talent is rewarded, we offer a simple tool for founders, CFOs, and HRs to set up and manage their ESOPs in no time and without any unnecessary hassle. The set-up follows a 3-step process:

Step 1: Decide on the pool size, a plan and grants

There are three critical components for setting up an ESOP: a pool, a plan and a grant.

- Pool - a number of shares that are reserved and approved for the ESOP by the board. It is usually 5-15% of the cap table, and it is common to top it up after a funding round.

- Plan - a set of clauses for a particular group under an ESOP. It can have more than one plan (e.g., one for executive employees and another for entry-level workers).

- Employee grant - an internal agreement between an employer and an employee that allocates a particular number of shares from the ESOP pool to the employee under prespecified (plan’s) conditions.

Before you can start granting stock options to your employees, you need to decide on the pool size (the percentage of equity allocated to ESOP) and the rules (vesting period and cliff, strike price, exercise window, good/bad leaver conditions etc.).

Step 2: Get approval

Those decisions need to be agreed upon with the board before setting everything up. Only when the pool and the plan(s) are approved can you begin the process of launching your ESOP.

Step 3: Set up an ESOP using an equity management tool

Finally, you can incorporate your employee stock option plan into the cap table by adding a pool. Then, it is a matter of minutes before you can begin granting equity to your employees. You need to create a plan using the approved terms. How to do all that will be described in the next section.

How to Manage an ESOP once Approved?

After getting an ESOP approved, you must incorporate it into your cap table. Setting up an ESOP using spreadsheets is a thing of the past and can lead to errors and a potential lack of visibility to most stakeholders. Using an equity management tool like Capboard can cut the time spent launching and managing an ESOP in half. Time is money, and at Capboard, we want to help you gain it back. Making sure that all the calculations and changes to the cap table are done correctly can literally save your company from a lot of trouble later on. We can all agree that nobody wants to deal with unexpected issues when raising new funds, can’t we?

So, let’s say you decide to give Capboard a try and set up your ESOP using our tool. “What is next?” - you may ask. Here is a step-by-step process that will follow:

- Complete an onboarding on the platform using a personalized process.

- Fill out all the necessary information about the pool and the plan.

- Begin granting shares to your employees with ready-in-1min contractual agreements that can be done in bulk.

- Add new hires to the plan and update the old ones.

- Be transparent and see how your employees flourish and advance your company forward.

Here is how Capboard can help you be transparent with your employees when having an ESOP:

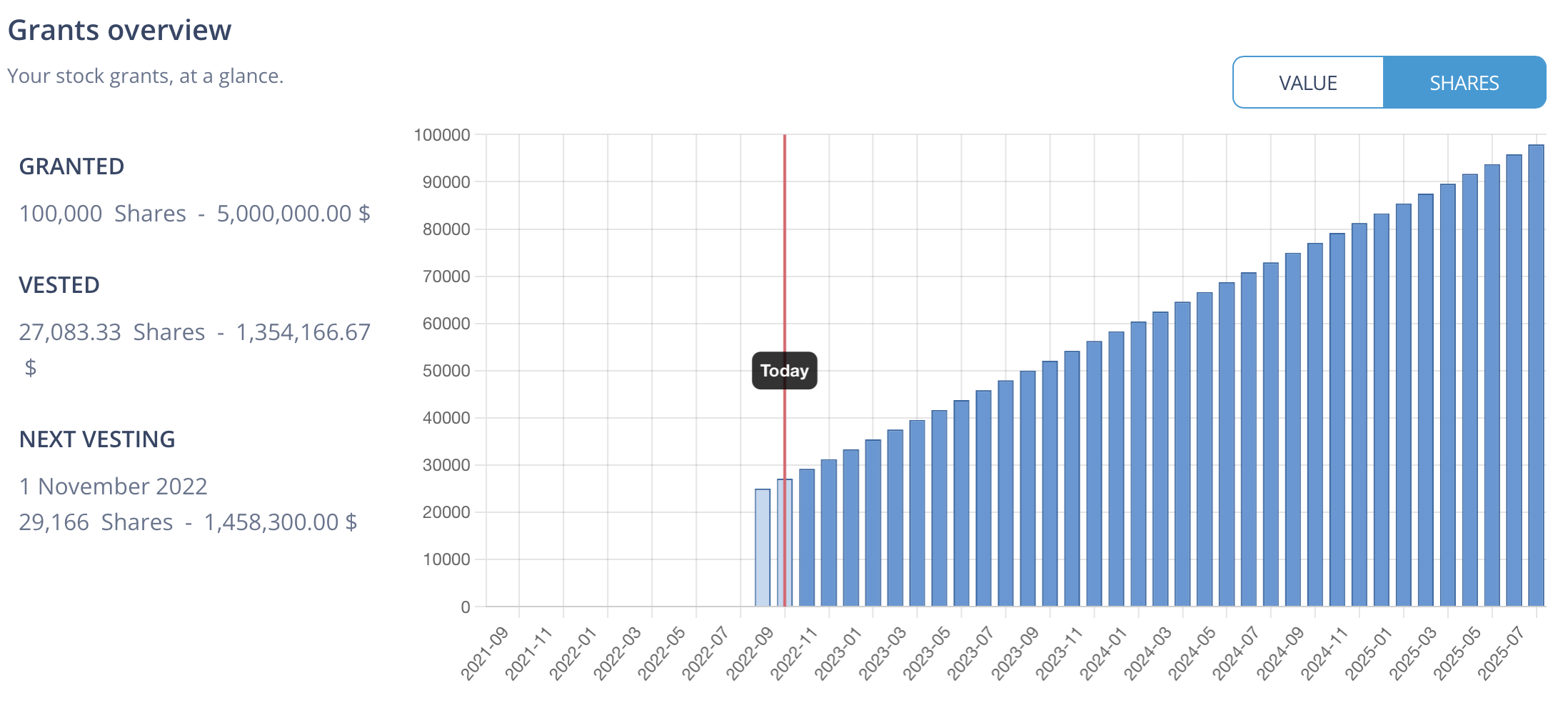

Let’s say that under the ESOP, you grant stock options. The idea is that employees who receive these will have a right to buy shares at an agreed price (strike price) in a prespecified future moment in time (exercise window).

Grant (an agreement dated 01.09.2021):

- Number of shares = 100000

- Cliff = 1 year

- Vesting = 4 years

- Start date = 01.09.2021

- End date = 31.08.2025

- Exercise window: 01.09.2022-28.02.2026

With Capboard, you can be transparent with your team. Here is how an employee will see her grants overview:

Ready to launch? To make it easy, fast and hassle-free, Capboard fast-tracks the process: from choosing the pool size to granting equity in bulk to employees. All while having complete transparency (when needed) for all the parties involved. If you want to learn more about how Capboard can help you successfully launch and manage your ESOP, please consider booking a 15 min call with our expert.

Legal and Tax Implications of an ESOP

While having an ESOP may sound like a perfect idea, some implications must be considered. Taxation is one of them. Understanding the tax framework for your particular situation can be crucial when deciding to launch an ESOP. Seeking legal and tax advice may be a great idea since the tax code differs in every country.

Index Ventures provides an extensive report created in 2018 on 20 European countries, Canada, the US, Australia and Israel and their corresponding taxation policies regarding ESOPs (may not always be relevant as 4 years have passed). Referring to this report can be a great start. However, we highly recommend seeking professional advice to ensure you leave no stone unturned and can make an informative decision based on your country’s current policy.

A tip: a country where an employee is based will determine the applicable tax laws.

Getting the Most Out of an ESOP

While we are talking about ESOP, it is essential to remember that not all employees may have a clear idea about how the plan works. To gain the most from setting up an ESOP, total transparency and clear communication between you and your employees must be a priority. Failing to educate and ensure that all the parties are on the same page can negatively affect your team’s morale and overall performance.

Here are the topics that you must address when communicating with your team:

- terms of the grant/plan (process, conditions, implications),

- costs involved,

- risk-reward relationship (best-case vs worst-case scenario),

- the way they will be able to track their grants,

- taxation.

Tip: Aim to bring everyone up to speed on the plan and its conditions while being transparent and clear.

Keeping all the parties involved in mind when deciding to launch a plan is necessary, but you should not forget to check in with your current capital structure as well. It is crucial to remember that an ESOP will have an impact on your cap table. Moreover, it will have different implications depending on the type of equity plan you choose (stock options, phantom shares, shares). Doing a simulation may be a good idea to understand how such a plan will dilute your company’s stakeholders. Capboard offers the possibility to conduct a variety of such simulations (e.g., financing round, ESOP, valuation update and others that affect a cap table). Do you want to make sure ESOP is the right thing for you? Book a demo call. We will answer any questions you may have and guide you through the process.

6 things to know about ESOP

Here are your takeaways:

- ESOP, also known as an employee stock ownership plan, is a benefit plan to attract, motivate, and align top talent with a company’s long-term goals.

- Key components of an ESOP are a pool, a plan and grants (stock options, stock, or phantom shares).

- Launching an ESOP requires the company board’s acceptance of the terms and conditions involved. Dilution, ESOP’s impact on the cap table and stakeholders’ ownership must be considered beforehand.

- Setting up and managing your ESOP after approval can be done successfully and quickly using equity management tools like Capboard, where the process is automated and effortless.

- It is crucial to consider legal and tax implications before deciding on the plan’s conditions.

- Transparency and clarity with employees can determine the extent of a plan’s success.

Make ESOP management easy with Capboard

If you want to learn more about setting up an ESOP - Book a demo call with us, and we would be happy to help you (for free).

However, if you are convinced that you are ready to set it up, don’t waste another minute and start rewarding your talent: Set up an ESOP.