Calculate the shares needed to maintain a specific % after a funding round.

Number of total shares of the company before the funding round

Capital to be invested to reach the target percentage.

Ownership target after completing the funding round

Your Startup Equity Dilution results

- New shares issued:

- Total shares after the funding round:

- Pre-money valuation: -

- Post-money valuation: -

Start for free

How the Equity Dilution Calculator works?

It is common among investors to have an ownership target on the startups they invest in. There are several explanations: to follow their investment thesis, for tax matters, or to manage a leaner portfolio. This calculator makes it easy to calculate how many shares an investor should own if they have a specific ownership objective. For example, how much should a venture capital fund invest if it wants 5% of the company funding round is completed.

- Existing Shares: number of existing shares before the funding round. If there is more than one investor, also take into account their shares.

- Investment: the amount the investor wants to invest.

- Target Percentage: % the investor wants to reach: 5%, 10%...

Once the data is completed, the calculator shows:

- New shares issued: number of new shares to be issued for this partner to reach the target percentage. Formula: Existing shares / (1- Target Percentage /100 ) - Existing Shares

- Total Shares: Total shares after transaction is completed. Formula: Existing Shares + New Shares Issued.

- Pre-money valuation: Valuation of the company before completing the funding round. Formula: Investment / (New shares issued * Existing shares)

- Post-money valuation: Valuation of the company after completing the round. Formula: Pre-money valuation + Investment.

What is Dilution in Startups?

While some founders may decide to bootstrap their business, companies with high startup costs often rely on external capital to finance early-stage growth. In funding rounds where the current partners do not sell any shares, new shares are issued, diluting the existing shareholders.

The impact of dilution is easier to understand with an example.

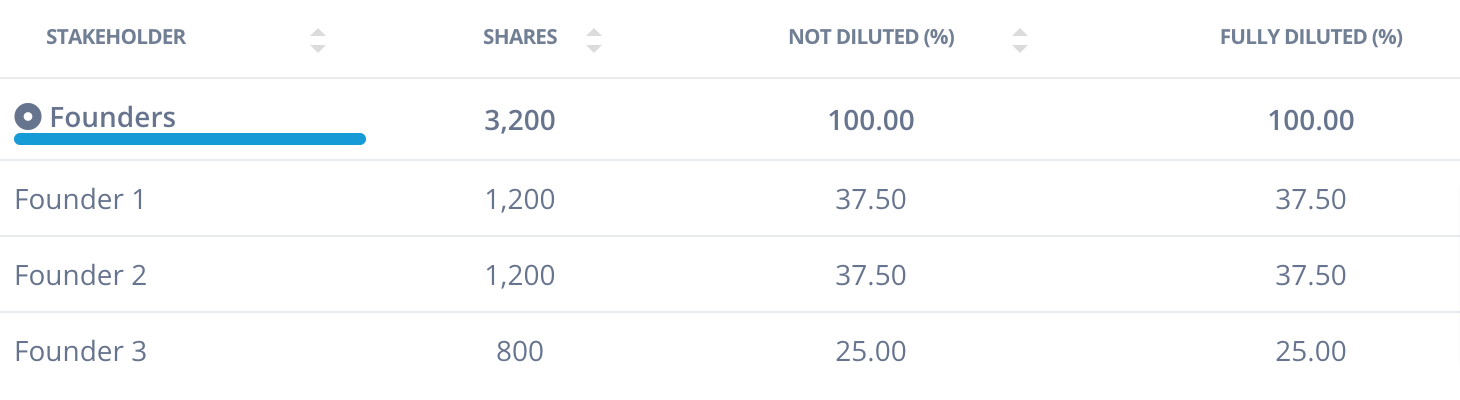

Incorporation

A company is incorporation with 3 founding partners who have 100% of the capital. There are 3200 shares divided into unequal parts.

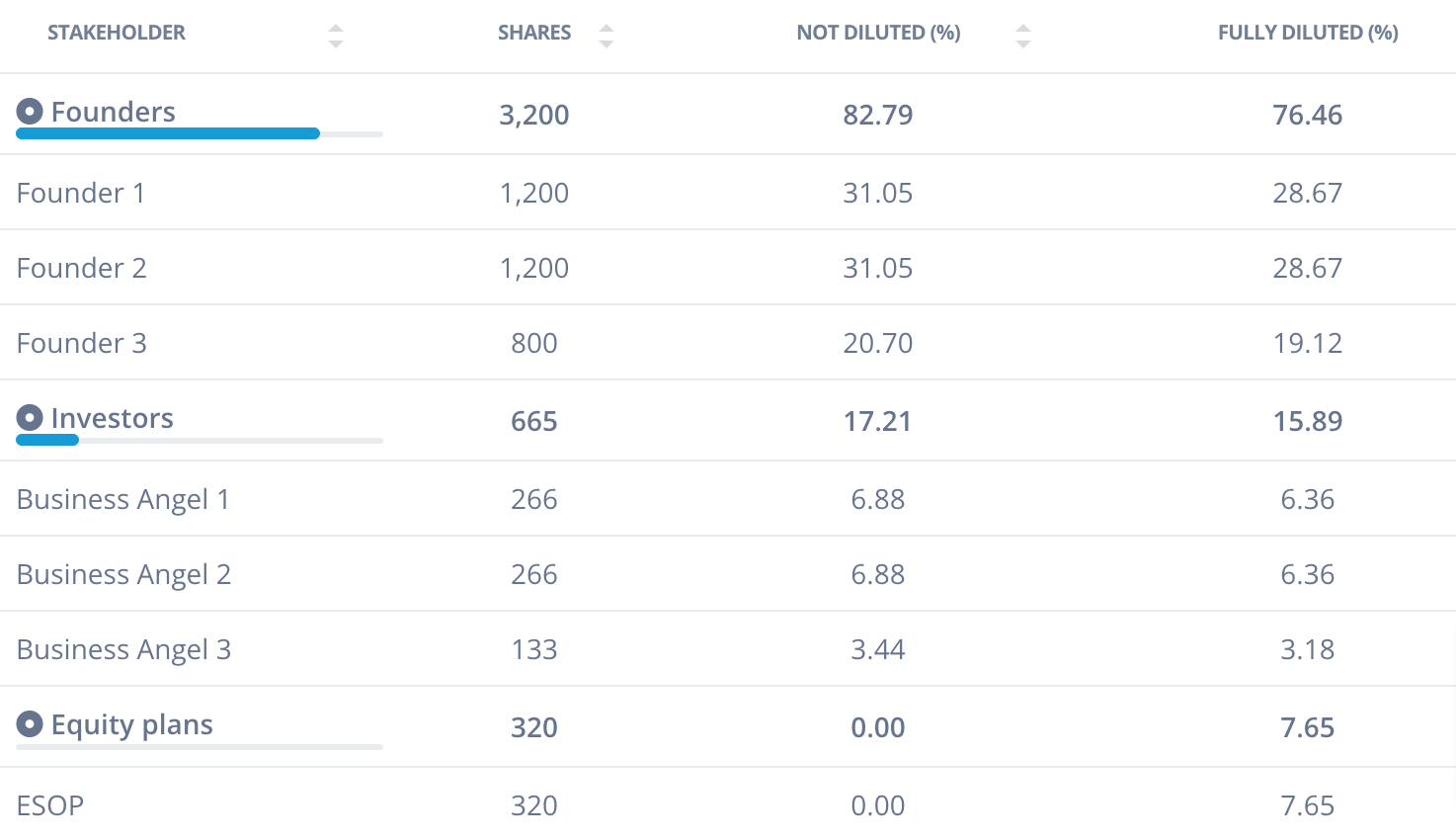

After the funding round

At that point, the company brings in 3 professional investors and launches an incentive plan.

- Funding plan: in the financing round, 3 angel investors invest in the company and 665 new shares are issued.

- ESOP: An ESOP is launched to help the company attract and retain talent. As it is launched with shares that have not been issued, vested nor exercised yet, the ESOP only impacts the fully diluted. Learn more about how fully diluted works here.

The capital increase has a direct dilution, and leaves the founders with 3,200 shares but 82.79% of the undiluted share capital. Instead, the entrepreneurs would have 76.46% of the company fully diluted.

Dilution is one of the main risks of relying on external capital to build profitable businesses, leaving the founding team with little ownership of the business. To fight against excessive dilution, capital efficiency and negotiating the valuation of the company is key.

Capboard's Cap Table by Share Class example: