What is Stock Vesting?

Stock vesting is the process of acquiring ownership of an asset (shares) over a period of time. A vesting schedule specifies how this process unfolds over the specified time period. Companies typically use stock vesting to retain key employees, granting part of them compensation in equity which vests on a monthly or quarterly basis. Vesting schedule applies both to employees who are part of an ESOP, and to startup founders that have raised external funding.

What is the cliff?

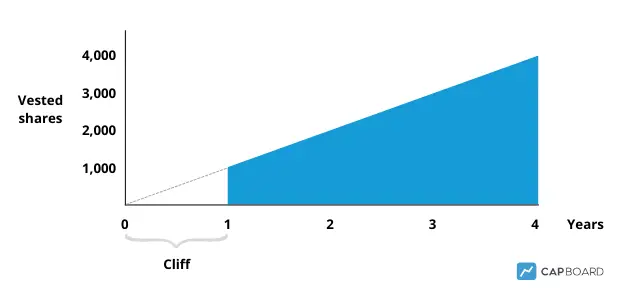

Cliff is a fairly standard clause that sets the vesting of the first part of the shares to a specific date, with the rest being unlocked periodically. The most common vesting schedule is a 4-year vesting with 1 year of cliff. This would mean that if the employment or professional relationship ends before the first anniversary, no shares would have vested.

An example: on 01/01/2023 an employee receives 4,000 shares with a 4-year vesting and 1 cliff. It will not be until 01/01/2024 that he will unlock 25% (1,000) of the shares. From that date on, he will vest periodically for 4 years until vesting all 4,000.

If the employment or professional relationship ended before 01/01/2024, the employee would not vest any share. Instead, if it ends as of the cliff date and is not considered a bad leaver (see Clauses section), he would keep all vested actions up to that date.

Types of Vesting in Startups

Depending on the use case and who receives it, we find two different types of vesting:

Time-based vesting

Vesting based on a schedule is the most common, and applies to any type of ESOP or shares. The main objective is to keep key personnel committed to the company in the long term, and aligning their incentives.

We recommend reading the section on clauses that usually apply to vesting.

Milestone-based vesting

Some vesting schedules models are based on the achievement of individual or business milestones, and do not usually require vesting. Examples of goals are completing a project, reaching a sales or EBITDA target, etc. Some companies have hybrid vesting, with a vesting calendar and milestones.

Milestone-based vesting is especially popular to align the interests of management teams with shareholders.

Reverse vesting

Reverse vesting is applied to founders when external investors invest capital into their company. These investors want to make sure that the management team and/or founders are committed to the long term, and usually suggest applying reverse vesting of 3, 4 or 5 years. Reverse vesting establishes that the founders own the shares if they do not breach the vesting schedule. In other words, unlike time-based vesting, the shares are already owned by the management team and will continue to be if they don't breach the agreement.

Reverse vesting tends to have a cliff, and the commitment may be renewed with each funding round. For example, if a startup raised a Pre-seed 2 years ago and reverse vested was agreed, founders may have to reset their commitment if they are now raising a Seed. In that case, founders would start vesting from scratch again.

These clauses are quite common, and tend to apply mostly to young companies to protect early stage investors.

Key Vesting Clauses

The conditions that may apply to stock vesting can be adapted to each case, depending on the objective pursued. It is key to know the most important clauses that can impact vesting:

- Good and bad leaver: vesting is the main formula for unblocking shares, provided that the person is considered a Good leaver at the end of the vesting or the employment relationship. A good leaver is usually anyone who is not a bad leaver. The company can tweak these definitions, but the most common is that bad leavers are people fired for objective reasons, who have acted in bad faith, or there was some kind of incident. In most cases, Bad leavers lose the right to all shares, even those already vested.

- Liquidity event: in ESOP vesting schedules or in shareholders' agreements, vesting accelerates or it is converted into shares when a liquidity event occurs. A liquidity event is usually an IPO (going public), an acquisition, or a merger with another company.

- Acceleration: is the clause by which if the liquidity event occurs, the share vesting is accelerated. There are different types of acceleration depending on the % of the vesting to be accelerated (full, partial). For example, if an ESOP is fully accelerated and the company is acquired 3 years after launching the plan, the participants will vest 100% of the shares.

Create your Stock Vesting Schedule with Capboard

Here is where you can begin: Sign up on Capboard.