What is a Cap Table?

In a company, the cap table or capitalization table is a document that details how many shares and of what type each shareholder has. It is usually managed by the management team or founder, with the support of lawyers.

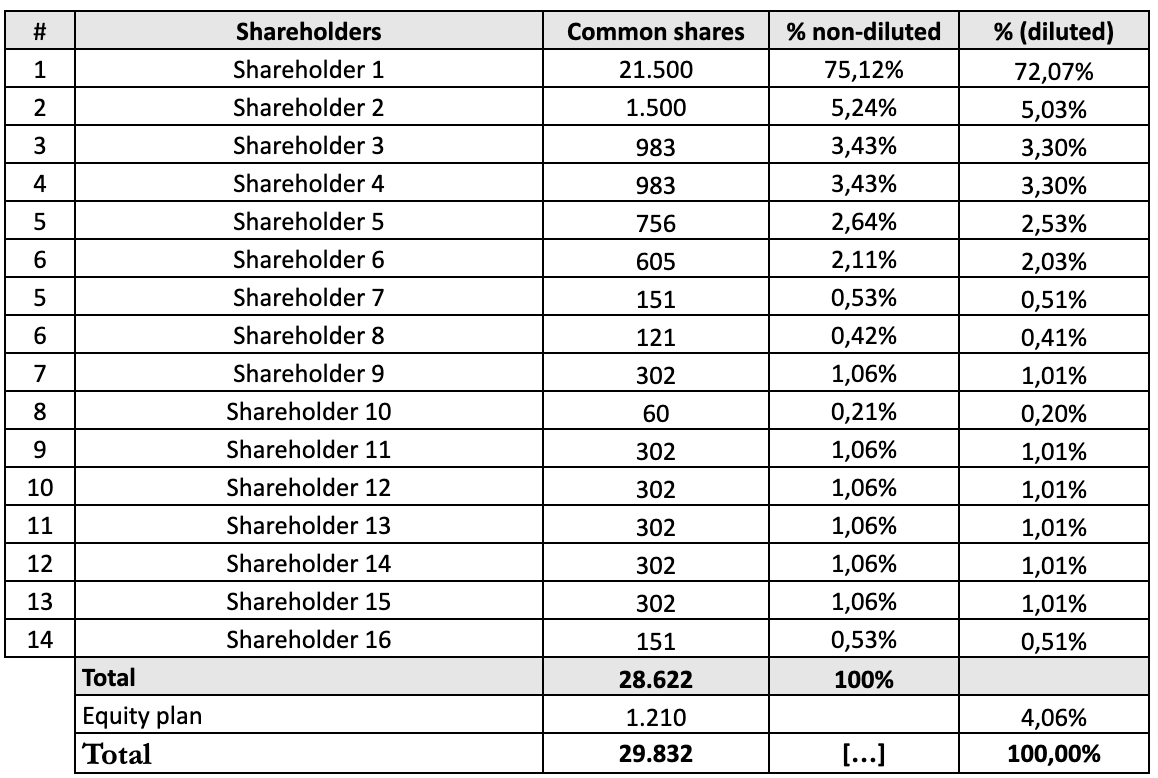

The cap table shows the different types of participations or shares: ordinary, preferred... and also those issued as compensation to the team such as stock options or ESOP.

What Details Should a Cap Table Include?

A company cap table shows the different types of holdings on the X-axis and the names of the corresponding shareholders on the Y-axis.

As a company grows and receives external investment, different types of participations are usually created to reflect the different rights and obligations. When it's born, a startup has the same type of common shares for all shareholders, but new types can be added (seed, preferred...) over time, when new investors become part of the cap table.

It is important to list each partner or shareholder separately in a column, as it will allow us to calculate majorities and have better visibility of the shareholding distribution. If the company has convertible loans or employee incentive plans, whether they are phantom shares, stock options or ESOPs, we also have indicate this in the cap table and it will lead to the valuation and fully diluted cap table. The fully diluted valuation takes into account the commitments acquired in the future but not yet materialized, such as incentive plans and convertible loans. At the time of the sale of the company, these commitments materialize in shares or economic rights.

The complexity of a cap table evolves with the company:

- At the idea stage, the founders are the only shareholders, with no vesting schedules and only common shares.

- Once the startup has been incorporated, the cap table may be getting a bit more complex as more details are added, such as the date of incorporation, the total number of shares, the number of shares issued to shareholders, including their issue dates and respective vesting schedules, etc.

- Following the company growth, the employee incentive plan becomes an important factor influencing the cap table, since 10% of the share capital is usually set aside to be allocated to founders or key employees.

- When professional investors or corporate partners are incorporated in the cap table, the cap table gets more complex with different share classes, vesting schedules and voting powers.

What Is the Purpose of Cap Tables?

The main function of the cap table is to show the percentage of ownership of the company, both to current partners and potential investors. It is essential to have the updated cap table when seeking financing, since all venture capital firms request it in the initial stages and also during due diligence.

Cap Table Online Calculator

Investors, advisors and lawyers are starting to ask companies they work with to have a digital cap table. The benefits are endless: efficiency, avoiding calculation or Excel issues, etc.

That's why Capboard has created an easy to use, free cap table generator for early stage startups. You can test it without having to sign up here.

Cap table template for Excel

Now that we have covered most of the components of a cap table, here you can find a basic cap table on Google Spreadsheet, with formulas included, that can be used for any early stage startup.

How to Digitize Your Cap Table

For companies that have completed several investment rounds, with stock option plans or convertible notes, it is advisable to digitize the cap table for the following reasons:

- All shareholders will have the same version: one of the main challenges of having the cap table in Excel is that it is difficult to ensure that all shareholders have the latest version. With Capboard, this won't be a problem as the cap table is in the cloud and up to date.

- Cap table history: check how the cap table or the valuation has changed over time.

- Financial calculations: investors in startups measure their returns with the IRR, and it is usually a manual calculation. By digitizing your cap table, we automate realized and unrealized IRR calculations for investors.

- Funding and exit simulations: what percentage of the share capital would you have after receiving 10 million investment at 80 million pre-money valuation? And if I later sold the company for 120 million, what would my payout be? How would control of the company remain if partner A sells in secondary its shares to partner B? Right now all of these calculations live in Excel and are very error prone. With Capboard, you can easily simulate financing rounds and exits, share those scenarios with partners, and make sure there are no mistakes.

- Document repository: as companies grow, the storage of key equity and legal document becomes more important. In most cases, these documents live in members' mailboxes. With Capboard, all documents are organized in a shared document repository among shareholders, with a powerful user permission engine.

With Capboard, you can create your cap table digitally and enjoy a 14-day free trial to explore all our features. Start now!