One of the easier ways for early-stage startups to raise money is to use convertible security. A convertible security is a financial asset that allows its owner (investor) to convert it into another asset (e.g., company shares). Simple Agreement for Future Equity (SAFE) is a convertible security that works precisely like that.

SAFEs became a popular method of raising funds for startups since they are much simpler than a proper equity investment that involves more extended contractual agreements, more negotiations and the high involvement of lawyers.

To learn about SAFEs and their key components, check out our guide to SAFEs.

What is a Pre-Money SAFE?

It is a contractual agreement between an investor and a startup that highlights the details of convertible security that will be converted to equity under specified conditions. Y Combinator created pre-money SAFEs to facilitate the process of fundraising for startups at early stages.

Here is how a SAFE works: an investor provides money to a company for the right to receive equity (shares) in the company later on in the future. When the investment money is obtained, a SAFE investor does not receive any shares. At this stage, no valuation was set to determine the amount to be issued and the price to be paid for these shares.

Under a pre-money SAFE, every new SAFE holder dilutes others (including the founders) when there are a few SAFE investors. Since the ownership of every SAFE holder is determined only when a new financing round takes place, there is much uncertainty for investors and founders.

Let's get through an example to see the process in practice.

How Pre-Money SAFE Works (Example)

Imagine a startup has 2 founders, each owning 1 million shares. So, in total, they have 2 million shares.

Stage 1: SAFE #1 and SAFE #2 are exchanged for the investment

Imagine investor 1 who decides to give $500 000 to a startup as a pre-money SAFE. Under the agreement, the pre-money valuation cap is $5 million, and there is no discount.

In addition, there is investor 2, who invests $800 000 under the same terms.

At this stage, the startup receives the money but does not issue any shares to our investors. Instead, only a right to equity in the future for the invested amount is granted. The conversion will occur when a new equity financing round takes place (seed or series A) - a trigger event.

To find out how much equity the investors will own, they must wait until the new financing round and when all SAFEs are converted.

Stage 2: The conversion is triggered

Now, the SAFE investment is converted to shares. Under the pre-money SAFE, the conversion price is calculated as follows:

Conversion price = Pre-money valuation cap / company's capitalisation (or a total number of shares before the new investment round and excluding all SAFE investments to be converted).

SAFE #1: In this case, the conversion price (inv. 1) = $5 million / 2 million = $2.5 per share.

The pre-money SAFE #1 investor receives = investment / conversion price (inv. 1) = $500 000 / $2.5 = 200 000 shares

SAFE #2: In the second case, the conversion price (inv. 2) = $5 million / 2 million = $2.5 per share.

The pre-money SAFE #2 investor receives = investment / conversion price (inv. 2) = $800 000 / $2.5 = 320 000 shares

Finally, our investors can determine the percentage of equity they receive before the equity investment takes place.

Since every SAFE impacts the other, the calculations are the following:

Investor 1 owns = 200 000 / (200 000 + 320 000 + 2 000 000) = 7.94%

Investor 2 owns = 320 000 / (200 000 + 320 000 + 2 000 000) = 12.70%

But a new financing round is yet to dilute everyone.

Stage 3: a new financing round (Series A)

A new financing round now dilutes all the SAFE investors and founders.

This equity investment is $1.5 million at a pre-money valuation of $10 million.

Series A investment:

The Series A price = Pre-money valuation / Pre-round fully diluted shares (excluding SAFEs) = $10M / 2M = $5 per share

Number of shares = Investment / Price per share = $1.5M / $5 = 300 000 shares

Stage 4: dilution

Total number of shares issued = Founders' shares + SAFE investors' shares + series A investor's shares = 2 000 000 + 200 000 + 320 000 + 300 000 = 2 820 000 shares

- Founder 1 owns = 1M / 2.82M = 35.46%

- Founder 2 owns = 1M / 2.82M = 35.46%

- Pre-money SAFE investor 1 = 0.2M / 2.82M = 7.09%

- Pre-money SAFE investor 2 = 0.32M / 2.82M = 11.35%

- Series A investor owns = 0.3M / 2.82M = 10.64%

Issues with a Pre-Money SAFE

Initially, there was only a pre-money SAFE. The people behind Y Combinator, the creators of SAFEs, realized that 2 issues with the agreement needed to be addressed. SAFE investments were getting bigger and often were stand-alone rounds. But, with pre-money SAFEs:

- Investors lacked the understanding of the percentage of equity they could expect to get.

- Startups lacked an understanding of the dilution they could expect from pre-money SAFEs

And that’s why a post-money SAFE emerged.

Post-Money SAFE: Explanation

The post-money SAFE differs from the pre-money SAFE and intends to solve the abovementioned issues. The most important difference between a post-money SAFE and a pre-money SAFE is that investors lock in a certain percentage of the equity in relation to other shareholders (including other SAFE investors). That is the case because a post-money cap is used (that takes into consideration all the investments of this ‘SAFE round’).

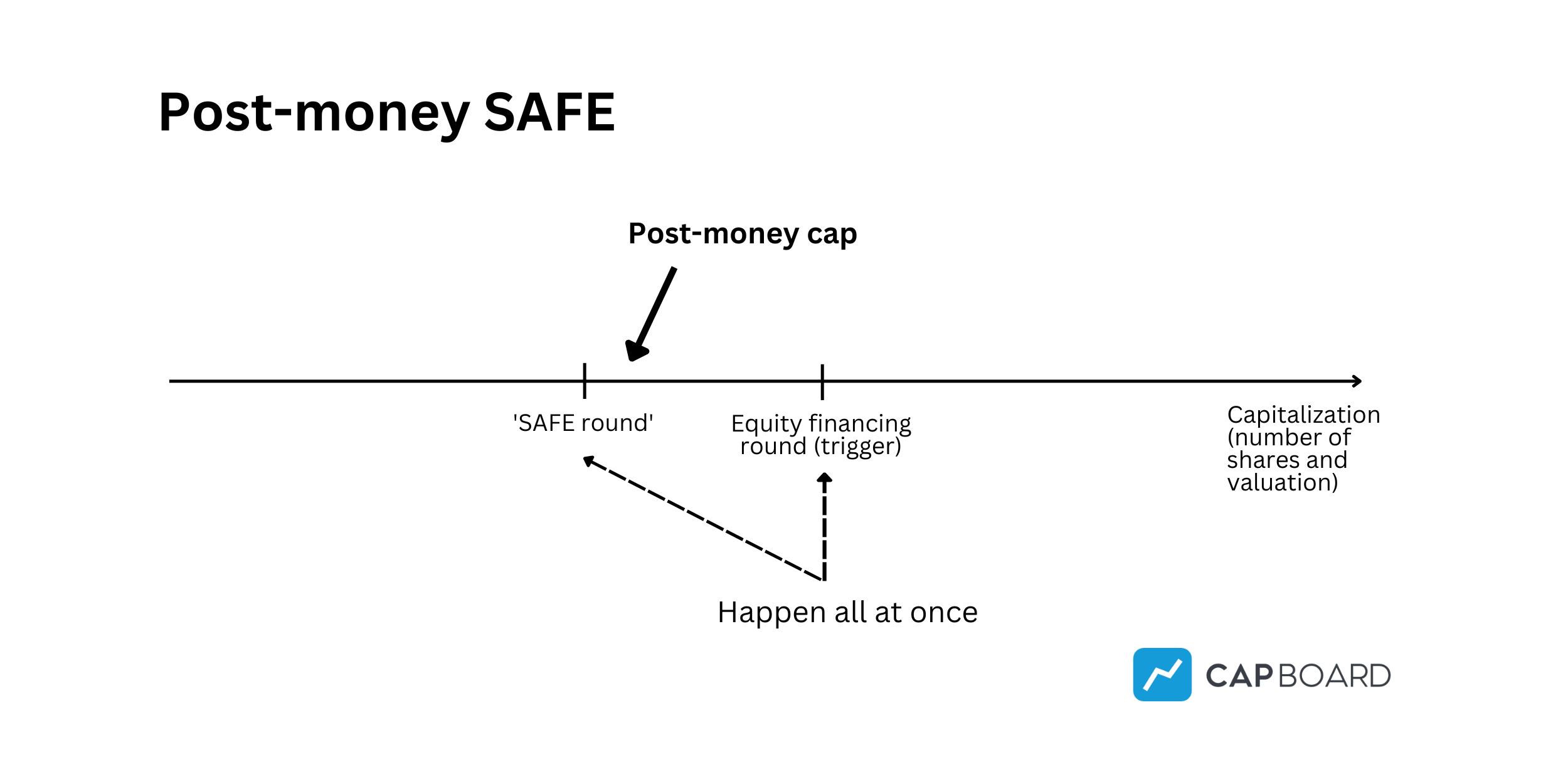

Here is what's essential about the post-money cap that plays a role in the conversion process. It is a cap for the SAFE round (of the conversion event, when all the convertible securities are converted) and not the cap of the equity round that triggers such a conversion (visually represented below).

In a post-money SAFE, the company capitalization consists of pre-conversion capitalization (shares owned by founders and any stakeholder on the cap table before the conversions take place) plus all the shares issued when SAFEs are converted.

That means that a post-money cap considers the pre-money number of shares + investment shares of the convertible securities. That allows locking in the percentage of equity in relation to other SAFE investors and pre-round shareholders.

A post-money SAFE gives more clarity and provides more certainty to investors and founders as they can know the ownership percentages in relation to other stakeholders right away before the new financing round that triggers the conversion.

Since the new financing round will dilute the SAFE investors, they will not know for certain the percentage they will own after this event takes place. However, they will still have more certainty regarding their ownership than when pre-money SAFEs are used.

Let’s dive into an example to understand the process better.

Post-Money SAFE example (Valuation Cap, No Discount)

Let’s imagine again a startup has 2 founders, each owning 1 million shares. So, in total, they have 2 million shares.

Stage 1: SAFE #1 and SAFE #2 are exchanged for the investment

Imagine investor 1 who decides to give $500 000 to a startup as a post-money SAFE. Under the agreement, the post-money valuation cap is $10 million, and there is no discount.

In that case, the investor locks in the following percentage for this conversion (SAFE) round:

($500 000 / $10 000 000) * 100% = 5% ownership.

That means, in this round of SAFE investments (‘SAFE round’), the company commits to give at least 5% of its equity to this investor.

In addition, there is investor 2, who invests $800 000. For the simplicity of the example, the same terms as for investor 1 are used. However, they could have different terms.

Investor 2 is expected to get:

($800 000 / $10 000 000) * 100% = 8% ownership.

At this stage, the startup receives the money but does not issue any shares to our investors. Instead, only a right to equity in the future for the invested amount is granted. The conversion will occur when a new equity financing round takes place (seed or series A) - a trigger event.

Stage 2: the conversion is triggered

When a new financing round triggers the conversion of SAFEs, the SAFE holders get their ownership percentages as calculated in the previous step. Here, the SAFEs do not dilute each other when converted.

Since SAFE holders are expected to get 5% and 8% of equity (a total of 13%), and given that the current cap table pre-conversion consists of 2 million shares owned by founders, the calculations to find out how many shares the company will have to issue is:

Total stock (founders + newly issued shares to SAFE investors) = 2M shares / (1 - 0.13) ≈ 2 298 851 shares

So the SAFE investors will receive: 2 298 851 - 2 000 000 = 298 851 shares

Investor 1 (5% out of 13%) = 114 943 shares

Investor 2 (8% out of 13%) = 183 908 shares

Investor 1 paid per share = $500 000 / 114 943 shares = $4.35 per share

Investor 2 paid per share = $800 000 / 183 908 shares = $4.35 per share

Both investors converted at the conversion price of around $4.35.

What’s important to mention here is that the conversion price can also be the one that is paid by the Series A investor. That would be the case if the Series A price would be lower than the conversion price determined by post-money valuation caps of the SAFEs.

Stage 3: new equity financing round (Series A)

The equity investment is $1.5 million at a pre-money valuation of $15 million.

The Series A investor pays the price per share that equals:

Series A price = Pre-money valuation / Pre-series capitalization (total stock or total number of shares including the SAFEs) = $15 million / 2 298 851 shares = $6.52 per share

Number of shares bought for Series A investor = Investment / Series A price per share = $1.5 million / $6.52 = 230 061 shares

Now, it is possible to compute the fully diluted percentage ownership of all the shareholders.

Total number of shares after the Series A round = 2 528 912 shares

- Founder A = 1 million / Total number of shares = 39.54%

- Founder B = 1 million / Total = 39.54%

- Post-money SAFE investor 1 = 114 943 / Total = 4.55%

- Post-money SAFE investor 2 = 183 908 / Total = 7.27%

- Series A investor = 230 061 / Total = 9.10%

Pre-Money SAFE vs Post-Money SAFE

Pre-money SAFEs are often used when raising funds from multiple investors, as they can help avoid later disagreements about valuation. Post-money SAFEs are often utilized when raising funds from a single investor, as they can simplify the negotiation process.