Equity compensation continues to gain popularity worldwide. Businesses offer equity to employees as a way to reward them and align their interests with those of the company without spending cash. But the success of equity compensation depends significantly on effective communication with employees.

Given the complexity of such compensation, we will present the best practices and strategies you can use to effectively communicate equity compensation to your employees.

Equity Compensation in Startups

Equity compensation refers to non-cash compensation provided to employees. Typically, it is done in the form of company shares or options to purchase company shares at a discounted price.

However, the type of equity compensation varies depending on the country you are legally registered in and the needs you may have. The most common assets used for equity plans are stock options, phantom shares, and restricted stock. Given the differences in terms of plans, it’s important to understand the implications yourself before building your communication strategy.

Offering equity to employees allows you to attract and retain top talent, inspire employees, and align their interests with the long-term success of the company. Equity compensation plans need to be created, approved by the board and setted up legally for the company to begin rewarding employees and adding equity into compensation packages.

Why is Communication Important in Equity Compensation?

Offering equity continues to gain importance in startup compensation, with US-based companies being way ahead of the curve. But globalization and quick adoption of startup founders worldwide makes equity compensation something that startup employees can expect globally.

Unfortunately, there is one thing founders often neglect when offering equity - employees need to be able to value this type of compensation. Understanding cash-based offers and what goes into other employee benefits is easy. Yet, equity-based rewards are not as straightforward. Failing to educate, communicate and provide employees with the necessary information and tools leads to a situation where the compensation is not valued.

As a result, startups give away equity to employees who don’t understand it and don't value it. Sad reality where neither the founders nor the employees benefit from such a powerful compensation tool. And that’s why communicating equity compensation to employees MUST be considered and a communication strategy has to be implemented.

What is the employment equity communication strategy?

An effective employment equity communication strategy can help make sure employees fully understand their equity compensation and are motivated to work towards the company's long-term success. It can also help build trust and increase employee engagement.

A communication strategy should play a significant role in your equity compensation programs. Here are the best practices and approaches you can use to create an effective employee communication strategy.

How to Communicate Equity Compensation to your Employees?

Employee equity communication strategy should consider 4 stages: when making an offer to a new employee, when launching an ESOP or any other equity compensation program and communicating it with your team, when managing the existing plan and its participants, and finally when offboarding an employee who is leaving. Here are the practices and strategies you can use at each stage:

When making an offer

Here are the practices you may want to add to your communication strategy when making an offer to new employees:

- Simple communication: Use simple language and avoid technical jargon that may be unfamiliar. The concepts and ideas behind equity compensation are not easy. Making sure potential employees understand what they are agreeing to is critical when making an offer.

- Tailor the message to the audience: Consider the audience and tailor the communication to their level of understanding. For example, executives may need more detailed information and a more personalized approach than entry-level employees.

- Be transparent: Transparency is key to building trust with employees. Clearly explain the terms and conditions of the equity compensation plan, including vesting schedules, exercise periods, and tax implications.

- Share a full overview of the entire compensation: Include salary, employee benefits and equity compensation when communicating the offer. You can also consider presenting multiple offers with varying degrees of equity vs cash compensation. It allows employees to choose the most desirable compensation package given their circumstances and needs.

When launching an ESOP

- Be public about your equity plan: All-hands meetings can be something to consider early on, even when not all employees are included and participate in the equity plans. It ensures transparency within the company. It also allows you to explain your goals and vision for such programs to the whole team.

- Use multiple communication channels: Use a variety of communication channels to reach employees, such as email, the company’s internal channels, and in-person meetings. It ensures that everyone receives the information and can ask questions.

- Provide ongoing education: Equity compensation is a complex topic. Ongoing education is necessary to ensure employees fully understand the benefits, their compensation value and potential tax implications. Regular training and resources to help employees stay informed help you achieve that. Without employees having a clear understanding, you will be throwing equity away.

We believe every employee should understand startup equity compensation even if they may not yet be a part of such a plan. A transparent communication policy on equity allows for building trust. Given a transparent and beneficial program, employees with no equity will be incentivised to strive to become eligible for such compensation and get promoted.

P.S. Don’t forget the implications of launching such equity compensation programs on your cap table. Because of the equity compensation programs, fully diluted ownership percentages of shareholders will differ from those without any equity plans. Shareholders will be diluted and own a smaller portion of the company's equity.

How to give employees visibility on ESOP value?

Having visibility over equity compensation value is one of the primary desires of every employee. Here are the strategies you can use to ensure effective ongoing communication and transfer of information to employees with equity compensation:

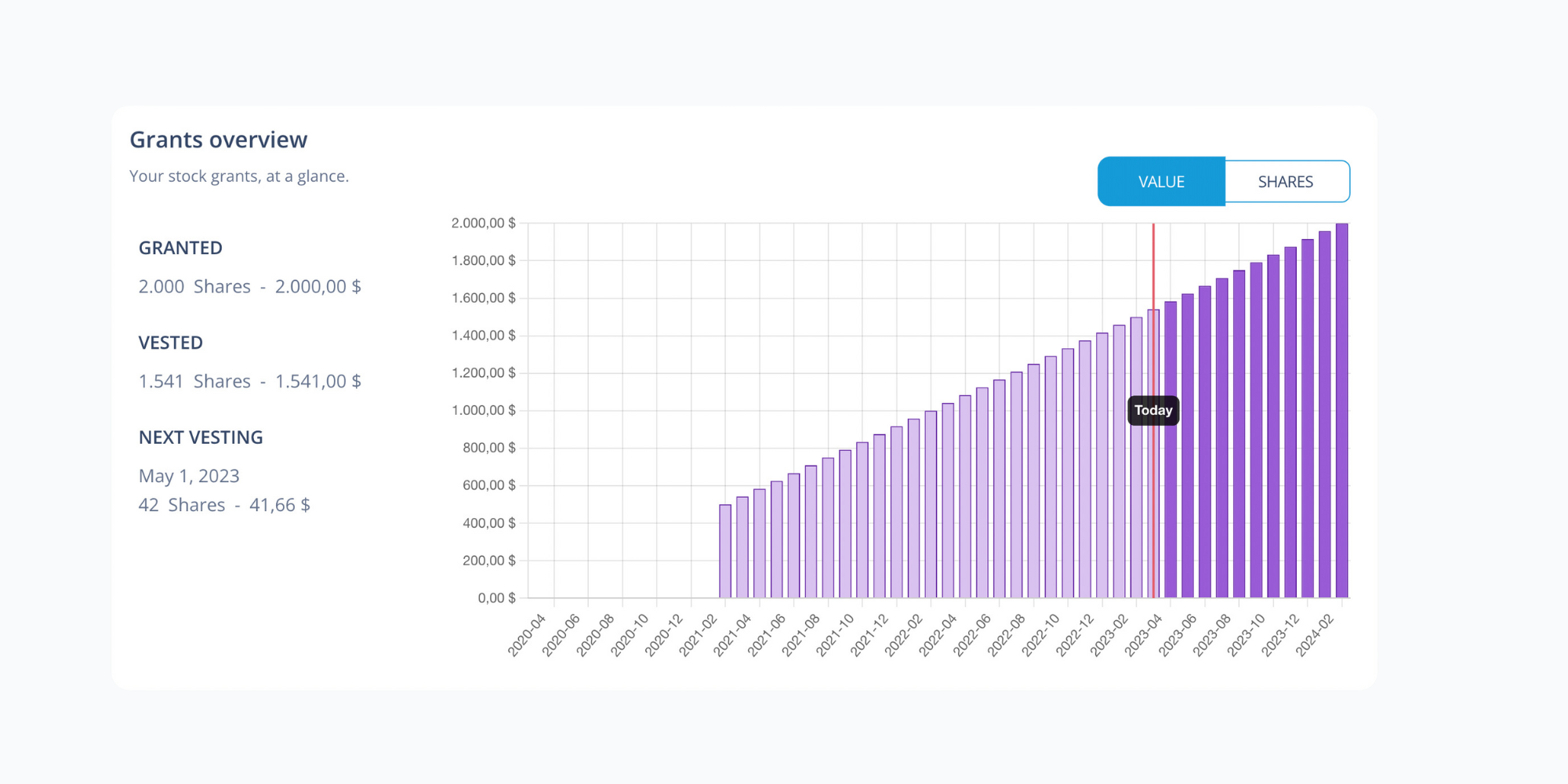

- Use visual representations: equity compensation and everything that goes into it (vesting schedule, shares, grants) are better perceived and understood when visualized and presented in an accessible manner. Since two of the most prominent elements of every equity compensation program are the value and the vesting, here is how hundreds of companies using Capboard provide visibility to their employees:

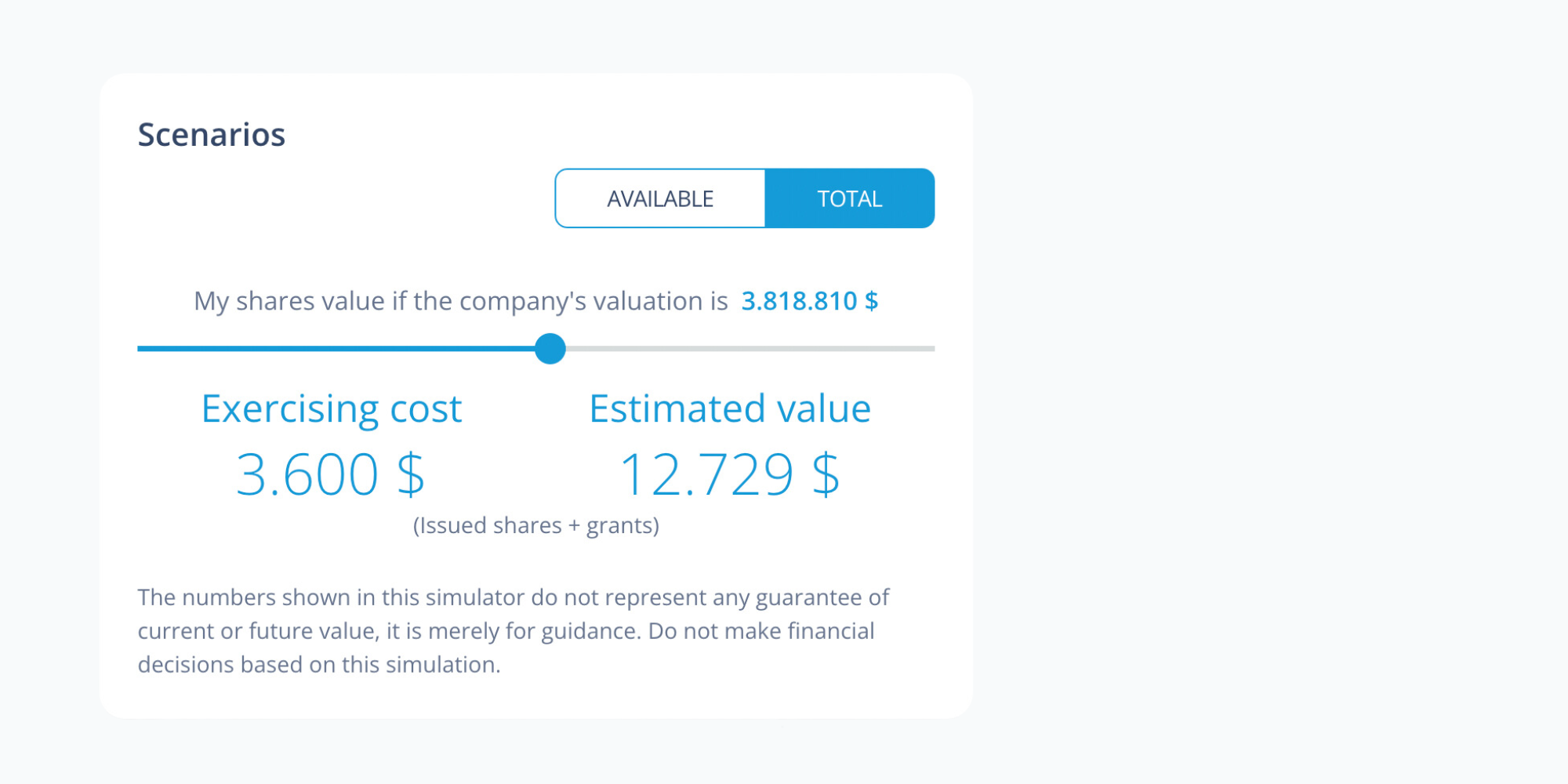

- Scenario modeling: Equity compensation depends on the company’s performance and growth. That’s why providing employees with the tools to engage in scenario modeling can be a great idea. Such a tool will add more clarity to the ESOP valuation for employees.

- Inform and celebrate successes: Sending grant letters and informing employees of reaching vesting milestones can be an excellent reminder for employees. Everybody wants to feel accomplished, and such a small thing as an email about newly vested shares can trigger positive emotions.

When offboarding

Employee communication on equity when offboarding refers to communicating with an employee leaving the company about the status of their equity rewards. It can help employees fully understand what happens with their compensation. First, it’s important to communicate whether an employee is considered a good or a bad leaver. It will have implications for their ownership rights.

In case the employee keeps the shares, it’s essential to communicate how many of those they vested and how to keep track of them. Companies using Capboard’s equity management solution can keep past employees in the loop with personal dashboards. When leaving, the employees will have to provide their personal email addresses that will be used to access their account on Capboard. Also, if relevant, communicating the deadline to exercise and the expiry date will be necessary.

Effective communication during offboarding can help maintain positive relationships with departing employees and minimize the risk of legal disputes or negative reviews. Companies may also consider providing departing employees with resources or referrals to financial advisors or other professionals who can help them navigate the equity compensation process. Clear, honest, and respectful communication can help ensure offboarding employees feel valued and respected, even as they move on to new opportunities.

What to do if your company is not doing well?

Everybody is happy when things are going great, and the company is growing. Employees, investors, you… everyone is passionately supporting and building the company. But, unfortunately, that’s not always the case. Startups fail, companies die, and organizations break down. When founders and executives feel like the end is coming, they typically don’t want others to know. Investor updates are not being sent, employees with equity are not informed, and the transparency and visibility they strived for take a hit. But it does not have to be that way.

A purpose-driven company with a solid culture can persevere. Continuing to be transparent and honest even during the downturn can allow you to connect with your employees further and give you and the company a chance to turn things around. Nobody likes losing, and when your team truly cares about the company and the vision you share, things can turn around for the better.

It’s also essential to consider a scenario where stock options become underwater. It’s when the fair market value (FMV) of the company’s stock falls below the exercise price. One thing you can do is extend the exercising window when assets can be exercised. It allows for more time for things to improve. In case the company’s FMV increases above the exercise price employees need to pay, exercising becomes financially plausible again.

Provide transparency to your employees with Capboard

Communication can either make or break your equity compensation programs. With a transparent approach to equity, you can ensure employees understand and value their equity compensation. So, do you want to provide visibility to your employees so your equity actually inspires?

With Capboard, you can get the most out of your equity plans, providing employees with much-needed visibility and clarity around their compensation.