Introducing the ultimate guide on cap table management for startups - an extensive resource to show founders the importance of a clear cap table for their startup’s success. Here you will learn how to maximize a cap table's beneficial effects on your company. We will also provide 5 tips for successful cap table management so you can improve your decision-making and be able to effectively manage your startup's equity while maintaining good relations with all of your stakeholders.

What is Cap Table Management for Startups?

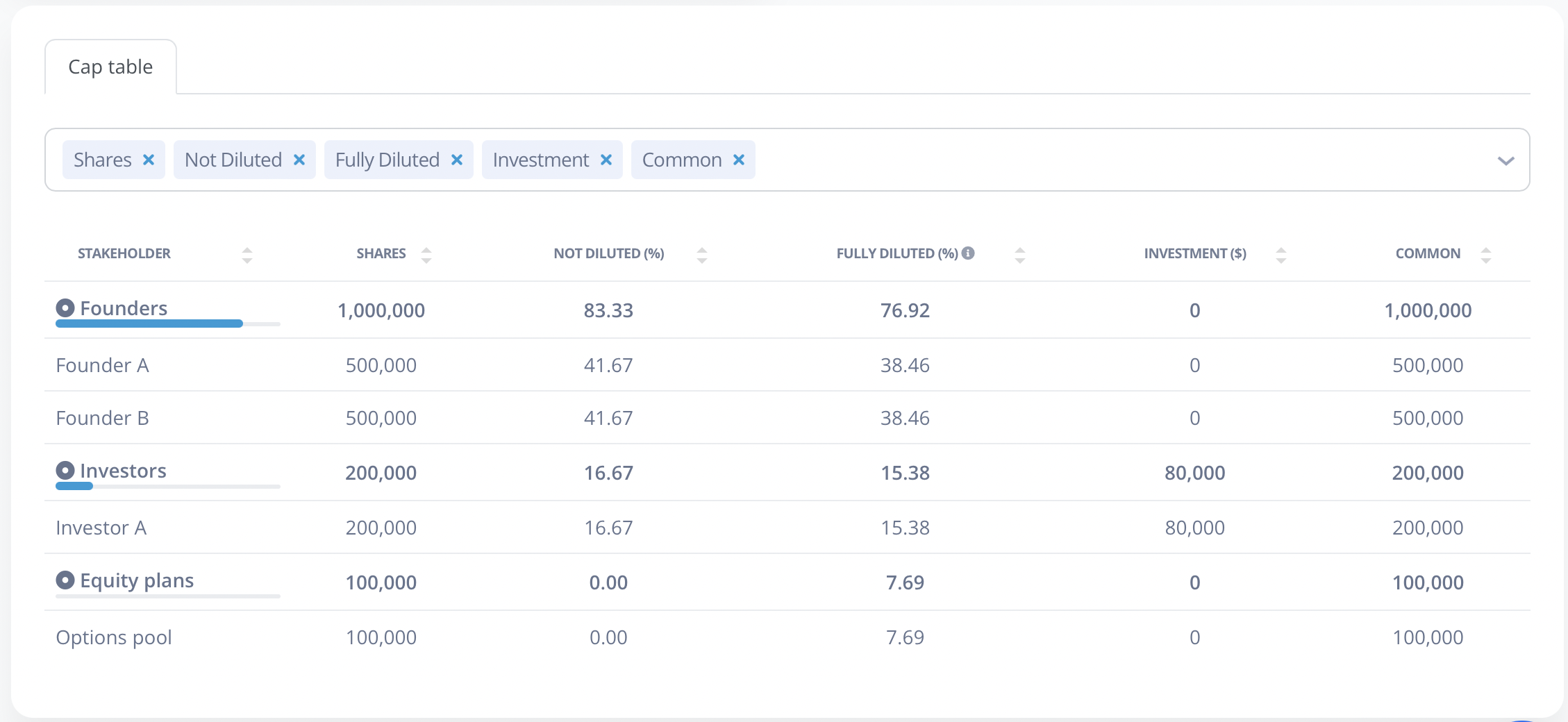

A cap table management for startups is a crucial process of managing an organizational tool that outlines a company's equity ownership structure. A cap table quantifies the equity stake held by each shareholder, allowing startups to keep track of who owns the startup's shares. This can be especially helpful when founders are looking to raise capital by offering equity to investors. By understanding exactly who holds what type of stock, founders can clearly communicate their goals and expectations to potential investors and form partnerships accordingly. Creating a digital cap table has never been easier - build your cap table.

The Purpose of a Cap Table Management for Startups

Startups often rely on a cap table to ensure an accurate record of equity ownership and keep track of who their shareholders are. These tables allow startups and their founders to clearly visualize equity ownership and other important financial information to avoid any potential disputes or miscommunication between owners and investors later on.

Additionally, startups that properly manage their cap table will be better equipped to make sound financial decisions for the long-term success of their business. As such, startups would benefit from taking full advantage of the cap table's capabilities, as it can serve an integral role in their growth. Learn what details a cap table should include if you want to build one now.

The Importance of Cap Table Accuracy

Accurate and up-to-date cap tables are essential for startups if you wish to view the equity ownership of all the shareholders clearly. The importance of a precise cap table cannot be overstated. If the cap table is not kept up to date, startups may face potential financial or legal problems. That's why it's critically important that you invest resources and time to keep track of shareholders, equity ownership, stock issuance and any other information related to your startup's equity.

Failing to keep an accurate cap table might lead to costly financial disputes or even legal proceedings further down the line. Founders need to remain vigilant about their records right from the beginning of their existence, especially if they want to increase their chances of success. Here is why...

How Cap Table Planning Can Benefit Your Startup?

Cap table planning can benefit your startup by giving you much needed visibility. This visibility allows making more informed decisions when fundraising, issuing new shares and growing your company. Startups' founders are often faced with questions regarding how investments will impact their company's future. Having a clear overview allows founders to understand better what range of options are available for rational decision-making regarding the future of the business.

Unfortunately, founders often give away too much of their company's equity when fundraising because of a lack of clear visibility over the consequences when giving away equity. Receiving investments is fun and awesome until you have to give a big chunk of your company's ownership to the investors and get diluted. Losing control of the startup and most of the financial upside is one of the most frustrating things that can happen to any founder. Thus, it would help if you safeguard your most precious asset - your startup's equity - whenever possible.

That is why the ability to make fundraising simulations and have a clear cap table is a game-changer in providing startups and their founders with the ability to plan ahead and increase their chances of success when fundraising and beyond. Capboard allows making such simulations and performing scenario modeling. In case you are planning to fundraise for your startup soon or doing it now, you can create a funding round simulation on Capboard and see how it will impact you and other current shareholders.

Cap Table Management for Startups: old way vs new way

Startups today increasingly face the challenge of managing ownership equity in the form of cap tables, which can become quite complex over time. Traditionally, startups used to maintain their cap tables manually on spreadsheets (the old way); however, with increasing business complexities and the expanding number of shareholders, legal and contractual needs and demands, this method is becoming less efficient and more time-consuming.

To meet these rising demands regarding cap table management and shareholder equity, entrepreneurs, CFOs and lawyers are now turning to cap table management software. Such a tool helps streamline tracking equity ownership data across stakeholders by managing all the information that goes into the process (the new way). It allows including contact details, vesting schedules, financial transactions and much more, all in one place.

In addition, software capable of automating complicated calculations like dilution percentages becomes extremely valuable. So, it’s no wonder startups are ditching their old approach in favor of automated systems that provide visibility into the health of an organization’s legal equity operations at any given time.

Common Challenges Faced in Managing Startup Equity and Stakeholders

One of the main challenges that startups face is the expectation put on founders regarding handling equity ownership. Shareholders, in particular, are interested in fairness, governance, and tangible returns on their investments. As a result, founders must find ways to make decisions while taking into account different stakeholder groups: company's investors, employees, partners and customers. This process requires thoughtful planning and navigation of regulations to ensure a balance between the rights of all entities involved. Equity and cap table decisions are no exception.

Additionally, startup founders should strive to create a culture where stakeholders can voice their opinions or intentions while maintaining corporate integrity. Building trust among stakeholders is critical for startups to ensure long-term success. Therefore, providing transparency, visibility and clarity regarding the company's cap table, growth, and equity are vital for building and maintaining trusting relationships with stakeholders. And sending investor updates is one of the ways to do so.

5 Tips for Successful Cap Table Management for Startups

Startups have a unique challenge managing their cap tables - equity ownership is complex, and the volume of data and stakeholders can be overwhelming. With a practical approach, however, startups can successfully manage their cap table and set themselves up for long-term success. Here are 5 key tips for founders to manage a cap table:

- Accurately track all activity in the cap table (stock issuance, equity financing, etc);

- Add relevant information and details about conditions and requirements (such as vesting);

- Keep in mind and plan for having employee equity plans (ESOP);

- Keep your startup's valuation up to date;

- Track and understand startup dilution;

By incorporating these tips into your strategies, while understanding the nuances of equity ownership and prioritizing transparency between founders and shareholders, you can create a strong foundation for your business and maximize the impact a clear cap table can have on your business.

How Do You Start Managing Your Cap Table?

Cap table management is a complex task for startups. Founders must devote time and thought to remain competitive and ensure long-term success. By utilizing automated cap table management software and following the five key tips outlined above, founders can successfully manage their equity ownership data, stakeholders and corporate integrity while building trust among all parties involved.

Finally, it's critical to remember that equity is a founder's most precious asset; losing it because of a lack of visibility and planning can be devastating. That is the main reason why we believe cap table and equity management is more important than it seems. With an effective approach and the right tools, startups can create a strong foundation for their business to thrive and grow. With Capboard, you can begin managing your cap table for free and start to enjoy the benefits of equity management already. Build your cap table with our free cap table calculator and make cap table management your superpower.