In the world of startups and entrepreneurship, founders play a paramount role in the success of an emerging company. Reverse vesting is a method used to incentivize founders to commit and stay with their company for years.

This article will provide a comprehensive overview of reverse vesting in startups, discussing its purpose, benefits, considerations, and standard practices.

What is Reverse Vesting?

Reverse vesting is the opposite of traditional vesting. In traditional vesting, founders or employees receive their equity outright and gradually become fully vested over time. However, with reverse vesting, founders initially receive their equity. Still, the company can repurchase or "claw back" a portion of the shares if certain conditions are unmet.

Let's say the founder decides to leave before the vesting period ends. Then the company can get the unvested shares back. That way, reverse vesting aims to keep co-founders with the company for a long term.

The Benefits of Reverse Vesting

The primary purpose of reverse vesting is to align the incentives of founders, employees, and investors with the long-term goals of the startup. Here are the main benefits of reverse vesting for your startup and its stakeholders:

- Protection for the company: Having ex-founders or ex-employees with high equity ownership on your cap table may be viewed as a red flag by investors. If the founder leaves, the company's stock can be reacquired.

- Retention of Key Stakeholders: Reverse vesting incentivizes founders to commit and stay with the company throughout the years. The vesting schedule ensures that the longer the founder stays, the greater his ownership in the company can be. Considering a successful scenario, selling the equity of such a company can mean a significant financial reward.

- Attracts investors: Committed founders highlight how serious they are to investors through reverse vesting. Many investors require reverse vesting for that reason. Also, having reverse vesting for founders suggests that investors have a higher chance of exerting more ownership control should a co-founder decide to leave.

- Flexibility of equity distribution: Reversing vesting is a structure that can be adjusted to the company's needs. The agreement can be flexible regarding the length of the vesting schedule, the number of shares and other vital elements. It allows creating personalized agreements around equity distribution in your company.

How can Reverse Vesting Harm Founders?

While reverse vesting can be advantageous, there are several things to consider when deciding on using reverse vesting or not:

- Potential loss of ownership: Under a reverse vesting schedule, a co-founder who leaves before the end of it will not gain anything from unvested shares. That also means loss of control over the company you started should you decide to leave early.

- Higher risk: Committing with a reverse vesting schedule means that if things go south early on, the risks are higher than when there is no vesting schedule for founders.

Considerations for Reverse Vesting

Reverse vesting is not an easy process. It requires legal support and has considerations that cannot be taken for granted.

- Triggering events: Specifying the conditions under which the company may repurchase shares that were not vested is crucial. A change in control over the business or a voluntary exit are frequent trigger events.

- Valuation and pricing: The agreement must specify all the details regarding the valuation and pricing of vested shares. It will prevent disagreements when events like a founder’s departure happen. When the reverse vesting is not followed, the purchase price is typically set to the nominal value (what the founder paid for his shares).

- Visualization of vesting: It's critical to have visibility over vesting. Like employees, co-founders would love to be able to track and keep an eye on their equity stake in the company, including how they vest their shares.

- Legal: Consulting with legal professionals can significantly simplify preparing and understanding equity distributions with vesting schedules. We highly recommend talking to an expert to ensure you understand the implications and can handle this step confidently.

What are the conditions the founder need to meet?

The conditions will vary depending on the needs and the agreement between the company and the founder. However, here are the typical conditions a co-founder can expect to meet to keep the allocated shares:

- Completion of the vesting period: Staying with the company throughout the whole vesting schedule is a critical requirement to vest the shares successfully. This period is clearly defined in the agreement with the beginning and end dates.

- Continued active involvement: Co-founders are expected to contribute to the startup's growth continuously. That means delivering on the promises and actively performing the given responsibilities. These can be a particular number of hours each month, specific tasks and activities.

- Compliance with restrictive covenants: Reverse vesting agreements may contain restrictive covenants that ensure no harm to the company. These can be non-disclosure and non-solicitation clauses that a co-founder must comply with to successfully vest his shares.

What happens when the founder leaves?

As was mentioned above, defining triggering events is critical. The departing co-founder will be classified as either a good or a bad leaver, depending on the reasons for leaving. A departing co-founder almost always loses unvested shares. Unless agreed with the rest of the shareholders, a co-founder would lose all unvested shares even when he’s classified as a good leaver.

The situation is much more complicated with vested shares. It isn’t good when a significant percentage of equity is owned by someone who is not actively involved in building the company any more. The company would be more inclined to negotiate a deal with the co-founder so the shares are repurchased. Negotiations play a critical role in such an event.

What happens with the founder’s shares after departure?

Unvested shares are repurchased back. Sometimes those shares can be divided among the remaining co-founders. The company can also own them and use them to attract a replacement.

Finally, the recovered shares can be used to increase the ESOP pool and granted to equity plan participants. With more shares available under the equity plan, your company can grant equity to key employees.

Common Practices of Reverse Vesting

While the specifics of reverse vesting agreements may vary, certain practices are commonly followed:

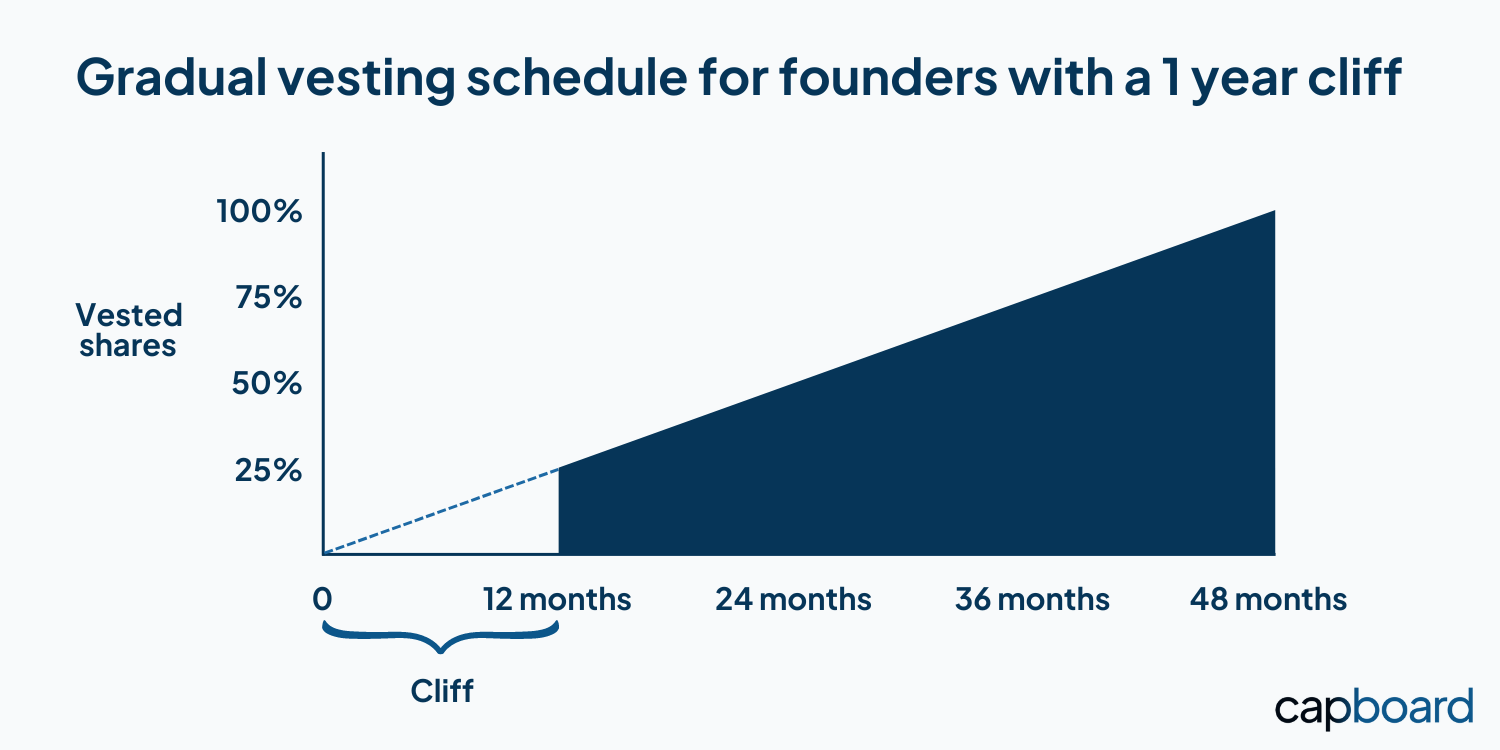

- Vesting period: The duration of the schedule should be carefully considered. While the average is 4 years, it can vary depending on your company's circumstances and the founder.

- Cliff: It is a period after the beginning of the vesting schedule when no shares are received. Typically, a cliff is 12 months. It ensures a minimum commitment for co-founders. When a co-founder leaves after 11 months, no shares are vested.

- Gradual vesting: A gradual vesting schedule means that the shares vest gradually over time (e.g., monthly vesting of 1/48 of the total number of shares if the vesting period is 4 years (=48 months).

- Accelerated vesting: Reverse vesting schedule may have an accelerated vesting clause, meaning vesting can happen faster under specific conditions. It can be triggered by the achievement of milestones or if something like a merger or an acquisition happens before the end of the vesting schedule.