As a startup, securing funding is often a crucial step towards growth and success. For many early-stage companies, Series A funding can be a significant milestone that allows them to scale their operations and develop their products or services further. In this article, we will discuss everything you need to know about Series A fundraising in 2024, including the benefits, challenges, and strategies for securing investor funding.

What is Series A Funding for Startups?

Series A funding is a type of investment that startups typically receive after securing seed funding and developing a viable business model. It is often the first round of institutional investor funding, and it allows startups to scale their operations and bring their products or services to market on a larger scale. Let’s dive deeper into how the Series A process goes and what is expected of you. As a side note: Don’t start raising a Series A round if you are not certain whether you can 5-10x your valuation.

The Series A Funding Process

The process of securing Series A funding typically involves a number of steps. Before securing Series A funding, it's essential to ensure that your startup is prepared for the due diligence process that investors will undertake. This process involves a comprehensive review of your company's financials, business model, and growth strategy, among other elements. But first things first.

Building Relationships with Investors

It's crucial to recognize the value of developing strong relationships with potential investors. For Series A funding, you will need to conduct extensive research to identify and target investors who are a good fit for the company and your vision. This process involves analyzing which funds have been active in funding Series A startups. It is essential to be specific and find investors within the same industry and geographical location. Moreover, you must know which investors are currently investing in the market.

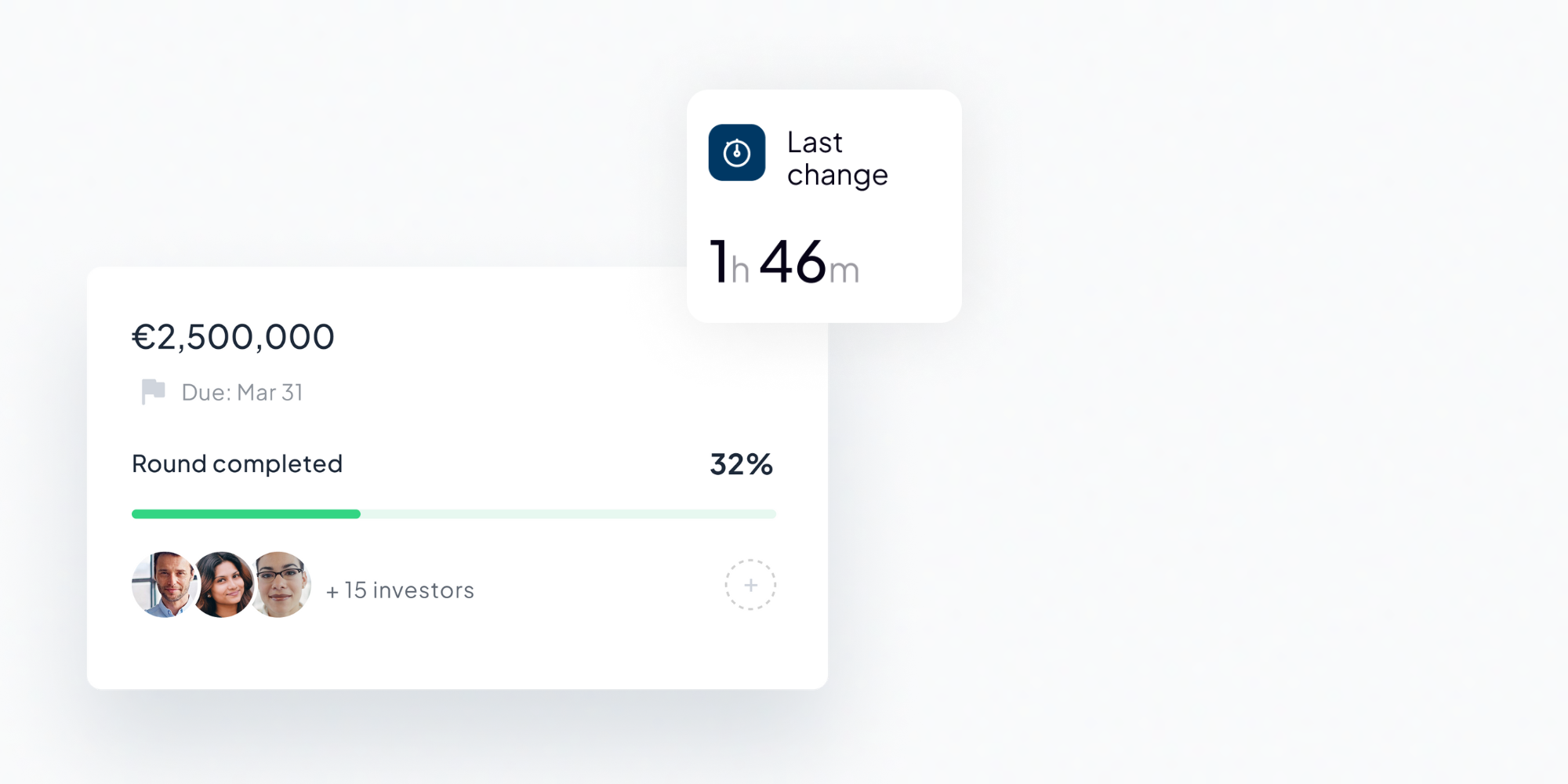

Besides identifying potential investors, startups should prioritize creating regular investor update reports. These reports can help generate demand from current investors and provide a way to communicate with potential ones. By consistently communicating with investors, startups can show their progress and milestones. That can further build investor confidence and trust.

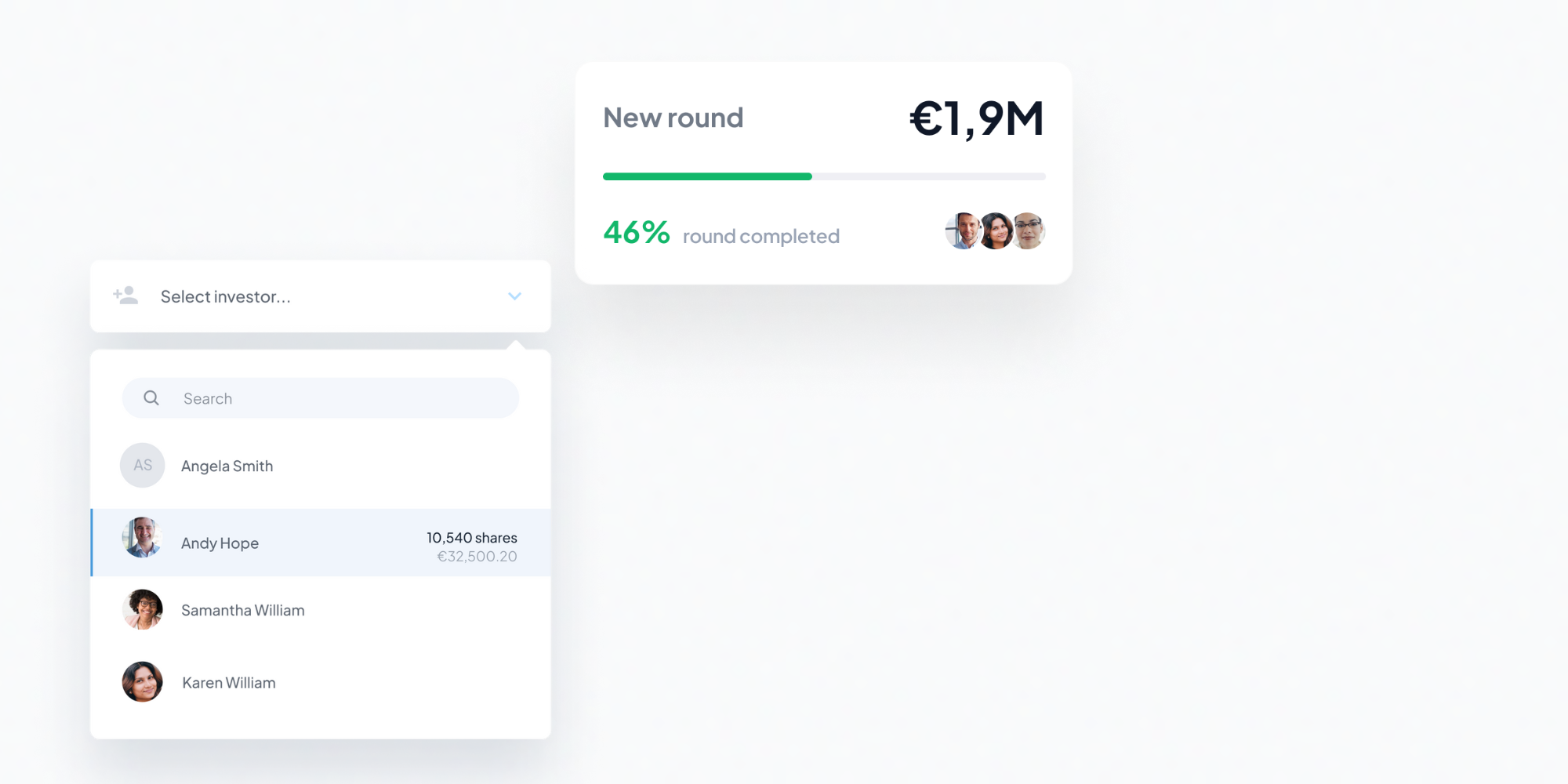

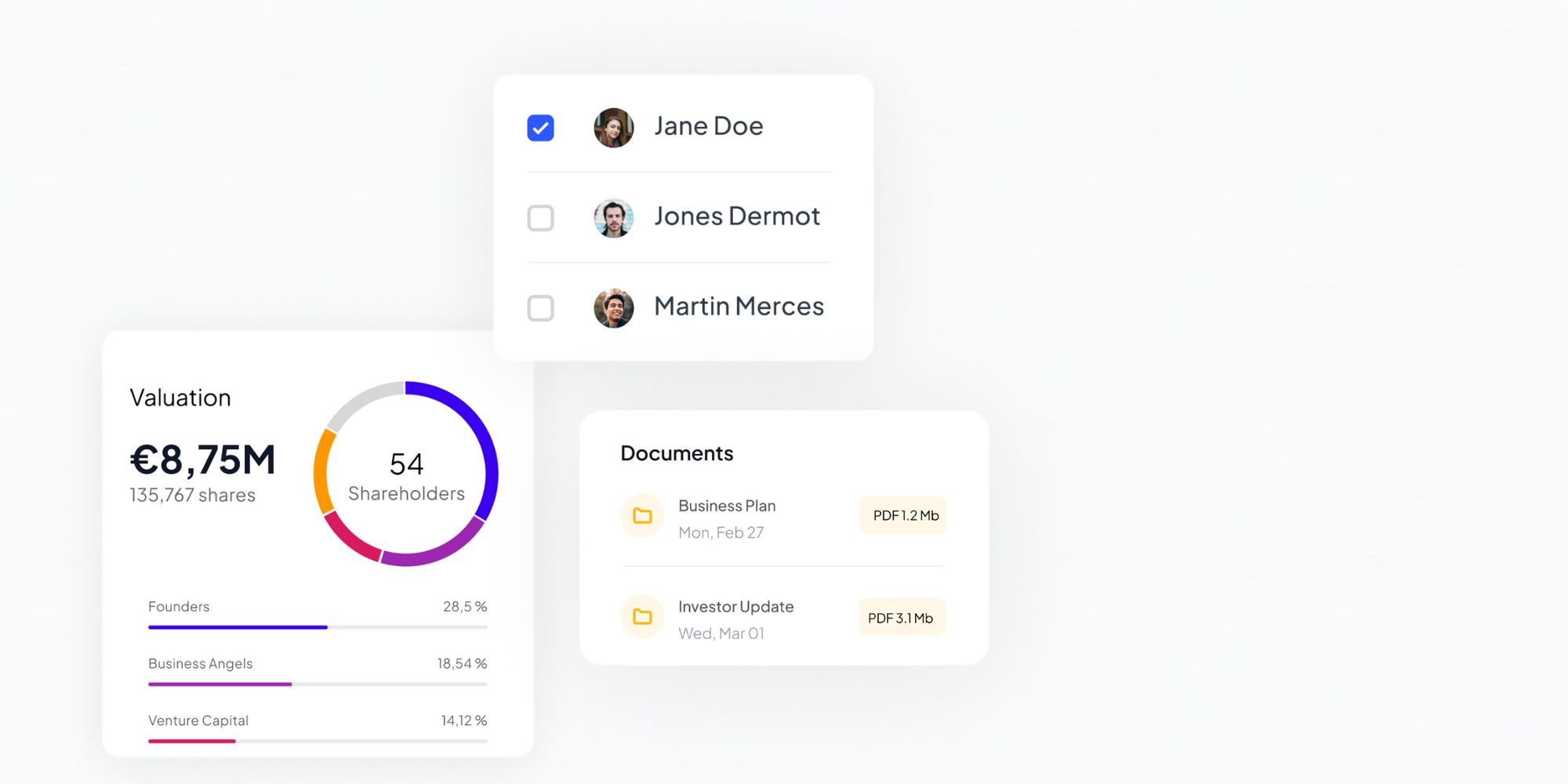

Overall, building relationships with current and potential investors can play a significant role when fundraising. So, in case you are looking for a way to streamline your investor management and have the tools to foster relationships with them, Capboard can help you. Provide transparency around equity structure and build trust with investors using investor reports in a few clicks.

Pitch Deck for Series A Fundraising

Preparing a pitch deck is critical to securing Series A fundraising for startups. A pitch deck is a presentation that outlines your startup's business plan, revenue model, and growth potential. It's essentially a visual representation of the startup's story and how it plans to achieve success. A well-crafted pitch deck can be the difference between securing Series A funding or not. Thus, it's essential to approach the pitch deck with a strategic mindset. Here is what to keep in mind:

- The first step is to determine the key elements that must be added to the pitch deck (market analysis, product/service differentiation, financial projections, and growth strategy).

- When creating a pitch deck, it's essential to keep it concise, engaging, and visually appealing. You should aim to keep the presentation to 10-12 slides. You can include graphics and visuals to add clarity and make sure the message is conveyed.

- The pitch deck should be easy to understand, even for those without a background in the industry.

- Seek feedback from advisors, mentors and investors. Make sure you refine the message so you can ensure that the pitch deck lands when it matters the most.

The role of a pitch deck in Series A fundraising cannot be overstated. Investors want to see the potential for growth and a clear roadmap to success. A well-prepared pitch deck can be a good signal for investors when they evaluate your startup. It is essential to create a concise, engaging, and visually appealing presentation to increase your chances of closing the Series A round successfully.

Negotiations with Investors

Negotiating is a critical component of securing investment for startups. It is a discussion between you and investors regarding the investment and its terms. The outcome of such a discussion will decide how much equity investors will get in return for their invested money (including everything else that goes into the agreement). You can use an equity dilution calculator to help you.

To negotiate effectively, founders are expected to have a deep understanding of the market and their own business. In addition to that, you will have to understand the goals and priorities of investors. You should be prepared to articulate your vision and demonstrate the growth potential of you startup while also listening to the concerns and priorities of the investor.

The elements that go into a term sheet that you will have to negotiate:

- Valuation and price

- Liquidation preference

- Employee option pool

- Anti-dilution clause

- Control rights such as board seats and veto power over key decisions

- Founder vesting schedules

- Drag-along rights that allows large shareholders force small ones sell their shares in case of an exit

One approach that can help startups negotiate effectively is to simulate the financing round. It involves creating multiple scenarios based on different investment amounts and equity structures. Using the simulations, you can then analyze the impact of each scenario on the business. Scenario modeling can help you ensure that you are taken advantage of during the negotiations. So it helps you make more informed decisions.

Due Diligence during Series A Fundraising

Due diligence is a crucial step in Series A fundraising. During the process, investors will carefully evaluate your startup. They will seek a variety of information to assess the viability and potential of your company. It can include questions related to unit economics, financial statements, cap table and equity structure, and employee compensation. In case you are offering your employees stock optins or other types of equity compensation, you may need to obtain a third party valuation (like 409A valuation for the US-based companies) to stay compliant with your country's laws.

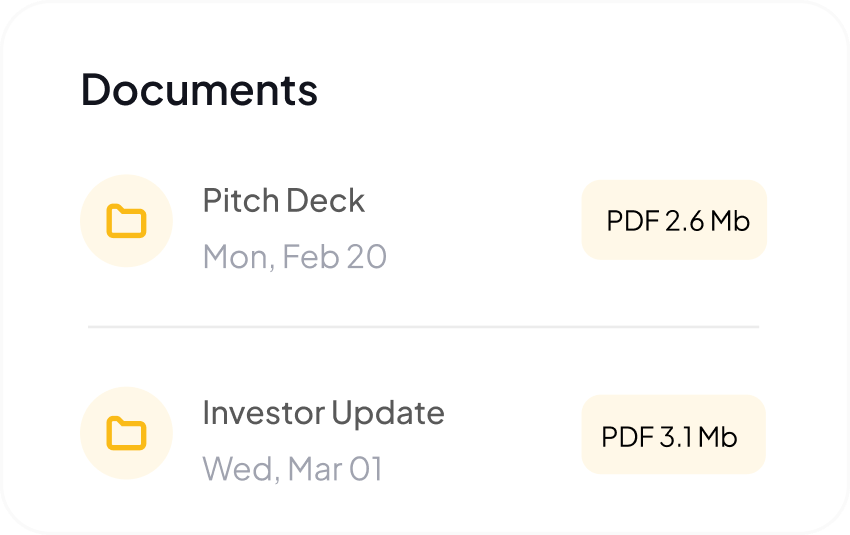

Nevertheless, you must guarantee that investors can easily obtain the most recent information about your company. With a lot of stuff required, the best way to ensure successful due diligence is by having an accessible virtual data room that contains all the necessary information and documents that investors may need.

Are you looking for a way to create a secure virtual data room and be able to track the engagement of investors with your documents? With Capboard, you can easily share files and equity data providing customized access rights to ensure that investors only have the relevant information available to them. It can help you streamline the due diligence process and build trust with future investors. See how Capboard compares to DocSend and other alternative virtual data room and file management softwares.

Closing the Series A Round

The final step in the Series A fundraising process is closing the deal. The investment has to be legally binding and should meet the needs of both parties. Therefore, the final steps are the following:

- The first step in closing the deal is obtaining the term sheet. It is a legal document that outlines the preliminary terms of the investment. Mainly, it confirms the amount of equity the investors will receive for a specified amount to be invested. Crucially, you determine your company's valuation at which the investment will be made. In addition, the initial agreement provides information on any special provisions or conditions and the rights and responsibilities of both the startup and the investors.

- With the preliminary agreement being drafted, both parties will review the terms and negotiate the rest of the contract. This process may involve multiple revisions and negotiation rounds to ensure both parties are comfortable with the terms.

- Once the investment agreement is finalized, you and the investors will sign the contract. At this point, your company will receive the invested amount. At this point, you must add the funding round to your cap table to highlight the updated equity ownership of existing and new shareholders. Since a Series A round is an equity investment, it is crucial to understand and check how it dilutes equity ownership and voting rights of existing shareholders in your newly updated cap table.

- In case you have outsanding convertible notes or SAFEs that are suppposed to be converted when the Series A round triggers them, you will need to make sure you perform the conversion correctly and account for every detail. With Capboard, you can automate the process and easily add the transactions in a few clicks.

- Once the investors become shareholders in your company, another responsibility may arise. Under some laws and regulations, you may be obligated to provide investor reports. Such a clause can also be included in the contract.

As a final thought, we want to let you know that you should have a clear understanding of your startup's valuation and growth potential. This can help you to secure favorable terms and avoid giving up too much equity in your company. It’s important to enter any kind of negotiation prepared. As mentioned already, you can do funding round simulations. This way you can ensure you make the best decisions by taking into account dilution, voting rights and equity ownership. With Capboard, you can do such funding round simulations in a few clicks.

Series A Startup Funding in 2024: Challenges and Solutions

The process of securing Series A funding can be a major milestone for startups, as it provides the necessary capital to scale up operations and accelerate growth. However, in 2023, the down cycle made it more challenging for founders to secure funding, and startups need to prepare themselves accordingly.

- The primary challenge for startups looking to raise Series A funding in 2024 is the increasing competition for a limited pool of investors. Investors are acting more risk-aversely. They are being more selective when choosing their investment possibilities as a result of the present level of economic uncertainty in the world. One strategy you can use in that case is generating the demand from your existing investors. Exploring whether they are willing to invest more in the Series A round or asking them for introductions in their network can be a great opportunity.

- Another significant challenge is the tightening of funding availability, as many investors are cutting back on investments due to the ongoing economic uncertainty. This means that startups need to be even more diligent in their fundraising efforts and explore multiple sources of capital to secure the necessary funding. Moreover, it is crucial to be prepared to answer questions about unit economics and profitability.

- Entrepreneurs also have to face the challenges of controlling rapid development, coordinating their staff with their objectives, and preserving a positive corporate culture. These elements are essential for companies that want to flourish over the long haul. A solid growth plan and excellent teamwork may help reduce the hazards of rapid development. Not to mention the importance of attracting and retaining a great team. Using incentive plans and offering equity (like stock options) and non-equity compensation (phantom shares or other employee benefits) with vesting schedules should be a part of the plan.

To secure funding in the current challenging environment, founders need to demonstrate their ability to adapt and innovate. This may include identifying new business opportunities, diversifying revenue streams, and demonstrating resilience in the face of uncertainty. Additionally, startups must leverage technology to its fullest potential and be open to exploring alternative financing options, such as crowdfunding or revenue-based financing.

Your Series A Funding with Capboard

With Capboard, you can make your Series A fundraising easier, faster, and smarter. Streamline your cap table due diligence, simplify investor communications, and add the transactions in a few clicks. Ensure you make the best decisions for your company by doing funding round simulations. Let’s make the fundraising process smoother and more successful: Take your startup to new heights with your fundraising assistant.